NEOLINK Industry Update – Emerging Issues Impacting Australian Supply Chains – Q4 2020

Monday 22nd of October

Dear Valued Clients,

As the dust somewhat settles over the significant ongoing union disputes at Port Botany from September we are all left with a more costly and congested port service.

In this update we will provide some detail on both the cost and service implications for the industry, as well as the risk management strategies importers/exporters are implementing to continue to reduce the impact on their supply chains.

Below we have provided a short summary on the Key Issues Impacting Australian Supply Chains:

Thinking forwards the below are the key Implications of all of the above issues:

Whilst demand remains high and shipping supply remains low or below expectations, rates could continue to increase between now and Chinese new year.

We have provided some key recommendations below and some solutions our Customer Operations Team have put in place with customers:

As we go into the end of the year we are dealing with an environment that has changed and as such we need to continue to evolve how we operate in this climate. Our Customer Operations Team are working tirelessly with overseas suppliers, shipping lines, terminals and carriers to ensure you are getting your goods as quickly and as cost effectively to you as possible.

Our team will continue to be proactive in engaging all of our customers on their outstanding orders and do our best to ensure we keep all of your customers happy for Christmas, as well as the new year.

Bring on 2021!

Best regards,

NEOLINK Management

ATTACHMENTS/REFERENCES

1. Morrison takes aim at maritime union over Sydney port dispute – SMH

2. Despite peace talks at Port Botany, container congestion remains critical

3. Containership behemoth stops Sydney services over disruption

4. Port Congestion Surcharge – Sydney _ Maersk

5. Temporary Booking Suspension to Australia – AAA network

6. Cosco Suspension of Southbound Booking Acceptance – AAA & ASAL

7. Hutchison Port Botany Union Stop Work – 24 hours – Friday 23rd of October

NEOLINK Update – Maersk Cease Bookings to Sydney and Fair Work Commission Hearing Scheduled for this Weekend

Thursday 18th of September

Dear Valued Clients,

Hope you are all well and are having good weeks.

As the situation at Port Botany continues to deteriorate; Maersk have made a decision today to cease all bookings from any overseas port into Port Botany (please see attached).

This is going to have a devastating impact on all affected origin ports:

All of our Customer Operations Coordinators would have been or will be in touch with you over the coming days to ensure we have all of your pending factory purchase orders as early as possible. This will allow us the time to best manage the situation by pre-planning as best we can for all purchase orders with the carriers to secure space.

This week; DP World have launched a legal application to cease the industrial action at Port Botany with the Fair Work Commission (FWC) which will be reviewed at a hearing on Saturday the 19th of September. Continuous vessel delays and empty parks being at a tipping point with capacity is making the situation challenging for all involved. Our team will continue to work hard to provide you the best service we can and we ask you please be understanding of the market/industry challenges we are facing.

https://theloadstar.com/importers-close-to-breaking-point-as-tension-rises-at-sydneys-port-botany/

If you have any questions, please feel free to reach out to any member of the NEOLINK Team.

Best regards,

NEOLINK Management

NEOLINK Update – Port Congestion Reaches Crisis Point

Thursday 10th of September

Dear Valued Clients,

Before we get into it….

I hope everyone is staying well and you, as well as your families are keeping safe during COVID.

Despite now being in an official recession and Melbourne still in lock-down, we have seen shipping demand increasing since March with no signs of it slowing down.

There are a couple of key factors driving this:

The above has put incredible strains on supply chains here in Australia and we are now seeing this manifest in a number of different ways.

So What is happening?

What does this mean for you?

What NEOLINK are doing for our clients?

As always our Customer Operations Team are working hard and proactively to engage you on your supply chains to ensure we are managing the situation the best we can.

I also ask that you rethink the lead times on your goods and allow for the rate increases/delays in your own supply chains internally, which I know have customer implications. In some instances we are being used by some of our clients to speak to their customers about the delays in addition to forwarding on our notices.

The situation is manageable, but challenging for every importer or exporter providing we can all work together between our teams and plan/engage across the supply chain as early as possible.

Please feel free to reach out to your Account Manager if you have any questions on any of the above.

Best regards,

NEOLINK Management

NEOLINK Announcement – Maritime Union of Australia Approved Industrial Action at DP World Ports – Commencing the 18th of July – 16.7.20

Thursday 16th of July

Dear Valued Clients,

We received notice last night that the Maritime Union of Australia (MUA) will restart government approved/protected industrial action at all four DP World Australia Ports nationally.

The industrial action adds to challenges the ports are experiencing nationally to keep container freight moving during COVID. Further complications have occurred in the past 48 hours as well due to vessels being delayed into port due to bad weather and landside congestion.

The below has been the initial details provided on the commencement dates and our Customer Operations Coordinators will be in touch for our import/export bookings that will be impacted:

FREMANTLE – commencing Saturday 18 July

MELBOURNE – commencing Tuesday 21 July

BRISBANE – commencing Tuesday 21 July

SYDNEY – commencing Saturday 18 July

As you can see in the above there are not any end dates provided by the MUA on this industrial action at this stage so we will keep you up to date as the situation unfolds.

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Brown Marmorated Stink Bug (BMSB) Seasonal Measures Update 2020/21 – from Sep 1st 2020 to 31st of May 2021

Monday 13th of July 2020

Dear Valued Clients,

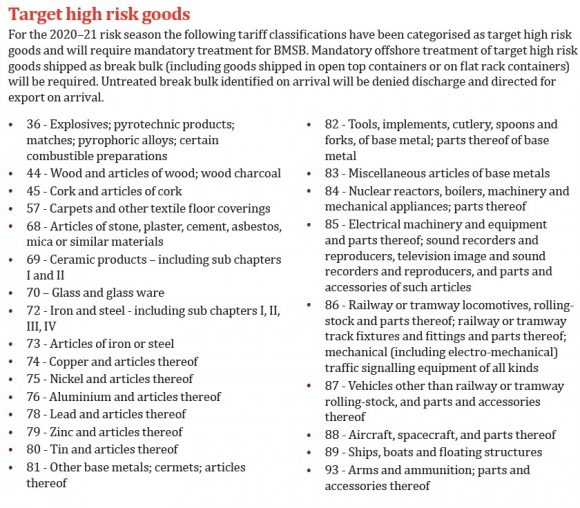

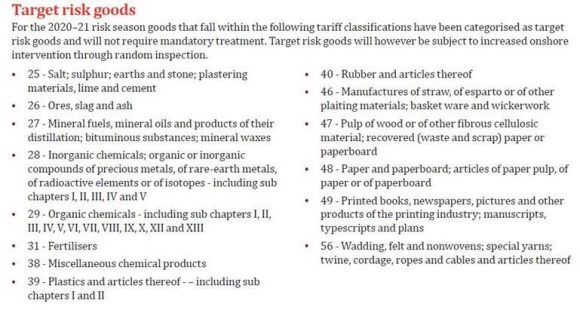

Recently the Department of Agriculture, Water and the Environment released their updated measures for the commencement of the BMSB Season for 2020/21.

I have attached/provided more detail below in addition to a Key Summary (however I strongly advise all importers to review everything thoroughly):

Seasonal Measures for the 2020-21 Brown Stink Bug Risk Season

In response to the rapid expansion of BMSB throughout in particular Europe and North America the Department of Agriculture has retained the same seasonal measures from previous seasons.

For this upcoming season, the below measures apply to:

From 1st of September 2020 and that arrive in Australia territory by 31st of May 2021 (inclusive)

The Department of agriculture has stated that they will be undertaking random inspections not just for the above targeted countries.

They are also going to be also monitoring “at risk countries” below and conducting random inspections for:

Treatment Requirements

If your goods are not classified as “target high risk” or “target risk goods”, BMSB seasonal measures do not apply.

Container Packing Guidelines

key factors that must be considered when determining the suitability of a consignment for treatment include:

It is important that all of the above information is shared with your suppliers to ensure compliance with the loading of your containerized goods. NEOLINK will work closely with our origin offices as always to ensure that we are meeting compliance on all of the above, but in a lot of instances where we are not in control of loading the cargo into the container so we need your suppliers to comply with the packing guidelines in the attached fact sheets.

Onshore vs Offshore Approach

Our recommendation as a business is to not take a one size fits all approach with regards to BMSB season and will take a client focused approach with clear recommendations.

There are a number of factors that NEOLINK and our Customer Operations will be taking into consideration when either recommending your goods for treatment at origin or upon arrival into Australia:

We will run each decision past our clients before fumigating/treating and our recommendation will be dependent on the factors above. BMSB Seasonal Measures not only put a cost implication on importers but also a lot of responsibility and compliance with regards to meeting the requirements of the Department of Agriculture. NEOLINK and our team are here to help you navigate through this season and are happy to provide as much advice as required to any key stakeholders in your businesses.

Best regards,

NEOLINK Marketing Team

NEOLINK Global Freight Update and Impact on Australian Supply Chains – 6.7.20

Monday 6th of July 2020

Dear Valued Clients,

As we continue to navigate these challenging times, we appreciate your support and understanding as we work together to manage your supply chains in the most effective way we can.

In this update I will go into some detail about the state of the global freight market, impact on local supply chains and more importantly what we can do to reduce risk to help deliver in full on time for all our customers.

If you are not able to read the detail I have provided a Summary of Key Points below:

Please ensure your NEOLINK Customer Operations Coordinator is kept in the loop on all PO’s that are raised with your suppliers. The earlier we are made aware we can provide our Purchase Order Management service to you all at no cost and this enables us to plan ahead with all carriers as early as possible. In some instances of port congestion we are working closely with our origin agent offices to analyse any shipping lines that may be over booked and ones that have space to provide you with real time updates and mitigate the risk of containers rolling at origin.

In addition to the above summary I have also provided more detail below across four of the major areas we are discussing with our clients at this point in time:

1.Global Ocean Freight Market and Southbound Services

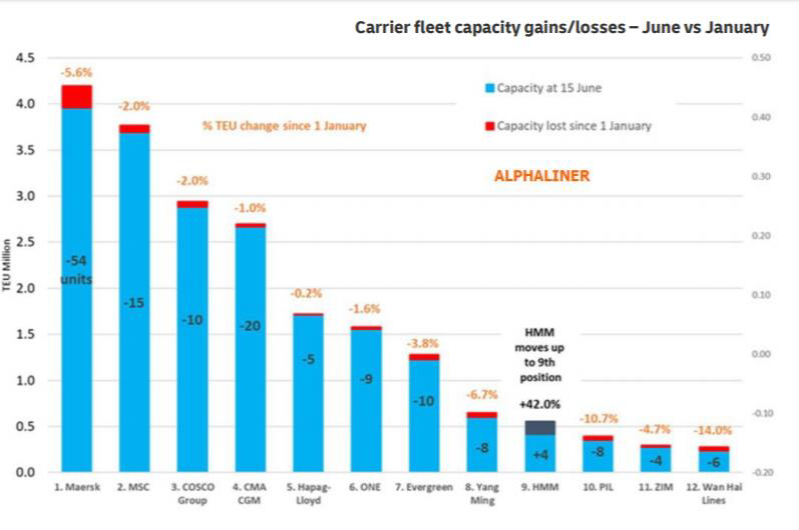

All except one of the major 12 shipping lines have reduced capacity by approx. 5% since the start of 2020 equating to 13.5 million fewer TEU’s being shipped (source: FBX Container Index). This contraction of supply has in the same time period seen an unexpected increase in demand from Australian importers, as our country effectively managed the COVID 19 outbreak relative to most countries.

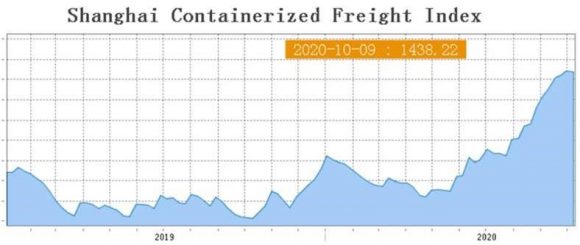

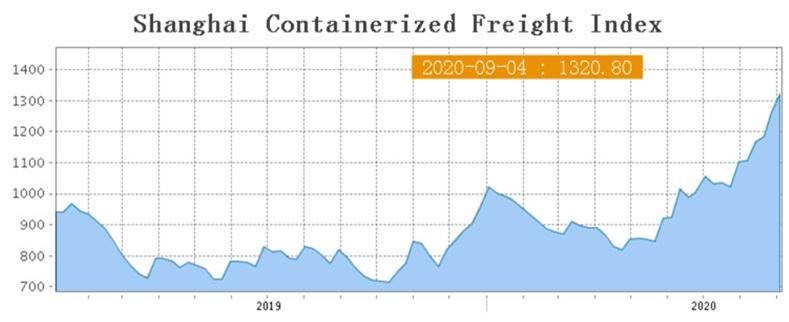

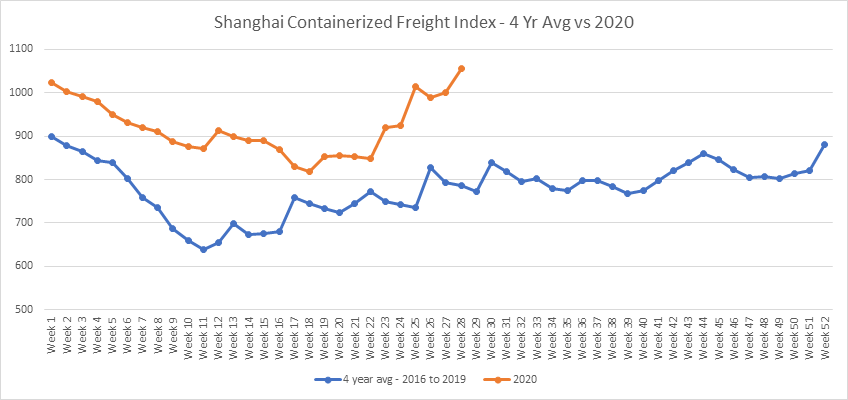

In the past four to six weeks we have also seen the Shanghai Containerized Freight Index and FBX Container Indexes increase by approx. 20 to 30% on average in comparison to prior years (see below). NEOLINK are constantly reviewing the market with our origin partners to ensure we get the best rates possible in market.

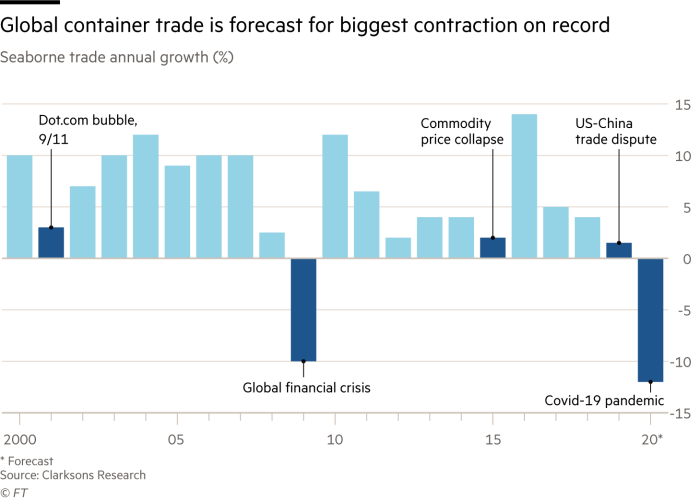

The main driver in the contraction of services put on by the shipping lines has been the overall drop in global trade, despite the growing and increasing demand from Australia. Importers have to contend with the unfortunate reality that global shipping lines seeing a significant drop in profitability in H1 of this year and may be slow to pass on rate reductions as they put on the additional services over “peak season”, due to other markets not performing as strongly.

The space issues incurring particularly at major tranship ports such as Hong Kong, Klang and Singapore are resulting in massive back logs as we head into July. After having conversations with PIL’s General Manager last week, they have over 4 weeks of back log alone in Port Klang, considerably impacting their southbound freight. Cheap shipping rates from tranship through these ports are attracting a significant number of bookings but with that is a high increase of those bookings being rolled or delayed.

One way we are mitigating this risk is by working with our origin partners to check on a daily basis which shipping lines are overbooked or have space relative to the rate and working with our customers on reducing the incidence or containers being rolled before they happen. This may result in rebooking with another line at a higher rate, but avoids delays where we can avoid them.

2.Shipping Line Contracts and Space Guarantees

Shipping Line contracts that are fixed with space guarantees are now starting to introduce new GRI and LSS Surcharges that are variable. Some of our biggest clients that have in excess of 1,000 containers per annum that had fixed rates are seeing their rates come in above market at a premium to hold the space and essentially no one is exempt from avoiding these costs. The shipping lines here locally do not have a lot of appetite at the moment for NAC (named account contracts) and are avoiding them where possible as origin offices are essentially doing what they want and delay bookings regardless of the importer.

Our recommendation as always with our clients is to play the variable freight market and allow us to closely monitor the market with our origin partners. Our Origin offices are always in close contact with your suppliers and working closely with them to forward plan as effectively as possible. If something is extremely urgent or you need a 100% guarantee, some lines will guarantee space at a premium of $200 to $300 USD per TEU if you need that security.

3.Australian Ports Infrastructure Costs and Sydney M8/M5 Toll Increases from 5th of July

In addition to the above Global Freight Market challenges, Australian Ports are implementing a “growth strategy” a term dubbed by Roger Fletcher from the Freight Trade Alliance (FTA) to steadily increase the per container infrastructure fee charges through 2020.

All of the State Governments have been asked by their respective transport ministers over the past 12 months to hold off on fee hikes at the ports and unfortunately has fell on deaf ears not only since COVID, but the past 3 years. DP World alone since the beginning of 2020 increased their port fees by 43% at Port Botany and further increases are expected to continue over the coming months. The Freight and Trade Alliance (FTA) are lobbying on behalf of all importers and Freight Forwarders to combat these charges, but to date have largely been unsuccessful.

DP Worlds Western Australian General Manager has stated “Our industry is experiencing rising costs in the most dynamic and competitive market conditions in decades. We are tackling this across a range of fronts, including delivery of further efficiency and productivity initiatives, and in recent months a workforce restructure. The continuation of the rebalancing of revenue recovery from waterside to landside is necessary to adequately account for landside costs, and fundamental to a sustainable future in this challenging market”.

As a lot of our NSW customers will be aware the new M8 connection opened last week and has resulted in the NSW Transport Minister imposing new toll increases on passenger, as well as commercial vehicles from the 5th of July.

The toll increase across both the M8 and M5 will effectively make it impossible for any delivery that is outside of Zone 1/2 to now avoid tolls, which we will pass onto our customers at cost. All of these increased costs of doing business are to be expected given the times, but we appreciate and understand the challenges these increases present on the ultimate landed unit cost of your goods.

4.Effectively Managing Supply Chain Risk for a Competitive Benefit

Despite the challenges presented, we believe that this also presents a great opportunity to work proactively with our customers to navigate this new market landscape and help compete. NEOLINK have invested heavily in systems automation & tracking capabilities to ensure our team are freed up to focus less on back of house to working closely with your suppliers, shipping lines and local carriers to ensure you get your goods as quick as possible in the most cost effective way possible.

Over the coming weeks our team will focus on engaging with you on the below:

Over the past QTR we have seen a lot of our customers successfully manage this climate by being agile and working with us proactively on all of their import requirements. We appreciate that these are challenging times, but we believe our core competency of combining great people with industry leading technology is leading to our customers in these times really seeing the services levels we can provide. Our team will continue to help support your businesses over the 2nd half of the year and keep you up to date as quickly as possible with any updates we receive.

Best of luck for the new financial year and the rest of 2020!

NEOLINK Management Team

Boot Buddy to Launch in Australia with NEOLINK as Appointed Distributor

NEOLINK have become the distributor in Australia for The Boot Buddy Ltd from the hit UK TV Series, Dragons Den.

4th of March 2020

The Boot Buddy Ltd and NEOLINK Logistics & Distribution today announced it has commenced working together on the distribution of Boot Buddy in the Australian Market.

Boot Buddy is on a mission to change the way people around the globe clean their muddy footwear. The founder, Arminder Singh Dillon was the youngest entrepreneur to get financial investment on the UK hit TV series, The Dragons Den at aged 15. Peter Jones, Deborah Meaden and Touker Suleyman all invested in the business and assisted the young entrepreneur in the business growth and expansion.

NEOLINK will begin distribution of the Boot Buddy Cleaner from the beginning of this year with a key focus on driving local online and digital channels. The innovative Boot Cleaner product will be the first of its kind to be launched in Australia and help parents of sporting kids “leave the outdoors outside!”.

“We have partnered in the past with Dragons Den UK brands with tremendous success and look forward to doing the same with The Boot Buddy” said Sean Crook, Director at NEOLINK. “Australia is a big sporting nation with over 63% of children participating in organized sport and approximately one million of them playing football, rugby or AFL. I am sure that a number of the parents of those children are experiencing the same problem as their counterparts in the UK that the Boot Buddy was able to solve”.

NEOLINK will largely focus the initial launch via its dedicated social media channels and online store to ensure Australians nation-wide can buy the Boot Buddy cleaner. “Through our logistics network we are able to ensure that the product is made readily available to ship at an affordable price to Australian consumers in a timely fashion. It is important we educate everyone about the Boot Buddy and that something like this is available here in Australia. Social media is a great platform for us to do that, where we can also share the Dragons Den story to promote the product and drive brand awareness for Boot Buddy with Australians.

“Boot Buddy is excited to partner with NEOLINK and help drive our brand in the Australian market” said Gurminder Dillon from Boot Buddy UK. “The Boot Buddy Cleaner will be available via the Boot Buddy Australia Online Facebook page launching in the coming week and the team at NEOLINK will be driving other new business channels across the country in the coming months ahead”

About Boot Buddy

The awesome Boot Buddy is highly convenient, durable and efficient product that is able to clean all the dirt on majority of boots and shoes out there. With its durable plastic pick and powerful brush with strong bristles it picks out the chunks of mud and grime on soles and sides of your boots and washes away and cleans EVERYTHING OFF! The best part is – it all happens in less than a minute! Suitable and recommended for Football, Golf, Horse Boots, Outdoors, Walking boots and much more.

About NEOLINK Logistics + Distribution

NEOLINK are a global logistics + distribution business with HQ in Sydney. They offer a full range of logistics services including air freight, sea freight, customs clearance, warehousing and transport. Leveraging the efficiencies of their logistics network; NEOLINK provide a full spectrum of distribution services for international brands looking for a partner in the Australian market.

NEOLINK Announcement – Coronavirus Update and Impact on Shipping from China – 17.2.20

Dear Valued Clients,

Given the continuing impact on the global economy the Coronavirus is having, I thought It was important to provide an update this morning.

The Coronavirus as I am sure you are all aware is having a significant impact on the global economy and is anticipated to have an impact on all countries gross domestic product this quarter.

I have provided a short breakdown below on how this is happening from a global logistics perspective and how this is impacting Supply Chains for you to share with your customers:

| A3S | OOCL/ANL/Cosco | XMN/SHK/HKG to SYD/MEL/BNE | * Three weeks blank sailing ETD SHK 19/2 + 24/2 + 2/3 * Shipping line arrange A3C sailing add call Shekou / HKG to take all AUEC booking ex S. China. |

| A3C | OOCL/ANL/Cosco | SHA/NGB to SYD/MEL/BNE | * In week 7 + 8 + 9 – add call Shekou / HKG |

| AAUS-SL/Yoyo | HSUD/MSC/Maersk/ONE | XMN/NSA/YTN/HKG to SYD/MEL/BNE | * Three weeks Blank sailing ETD YTN 16/2 + 23/2+1/3 * Shipping line arrange AAUS-NL sailing add call HKG to take all AUEC booking ex S. China. Booking ex Shenzhen/PRD via HKG. |

| AAUS-NL / Boomerang | HSUD/MSC/Maersk/ONE | TAO/SHA/NGB to BNE/SYD/MEL | * In week 7 + 8 + 9 – add call HKG |

| CA6 | ANL/EMC/HMM/HPL | TAO/SHA/NGB/YTN to SYD/MEL/BNE | * From week 8 – change the routing – first calling Melbourne then Sydney and Brisbane * extend 6-7 days T/T to SYD |

| ANZEX/CNS | OOCL/ANL/Cosco/HPL | SHA/NGB/SHK to BNE/NZ ports | * Blank sailing ETD SHA 14/2 * The sailing ETD SHA 21/2 omit call Brisbane |

| ANZL/JKN | HSUD/Maersk/ONE/Cosco | SHA/YTN/HKG to BNE/NZ ports | * From week 8 – extend 7 days T/time to Brisbane and New Zealand ports. |

So what can we do and what is our recommended approach?

Control the controllables! Please ensure that the NEOLINK team are aware of ALL of your pending/upcoming purchase orders along with the factory and load this into the system (we will also proactively reach out). This will enable us to forward plan as much as possible and ensure that we can work with the carriers to manage accordingly. Please DO NOT hold onto orders and then approach us at the last minute expecting a booking – our team will do our best in this situation, but there is a higher risk with this approach in delays occurring. Please leverage the Purchase Order Manager Service we offer (free of charge and part of our offering) and let us manage/prebook accordingly.

Despite our above recommendation there is still a high probability of delays occurring across all carriers and ports in the coming weeks, so please manage your customers’ expectations accordingly. Alternatively; Chris and I are also have to speak directly with your customers to answer any direct questions they might have if they want a bit more insight into what is occurring.

Best regards,

NEOLINK Marketing Team

New Starter Announcement – Matt Cirson – Business Development Manager – 10.2.20

Monday 10th of February 2020

NEOLINK are today excited to announce the appointment of Matt Cirson as Business Development Manager . Matt will be responsible for sales team leadership, driving new business revenue, new client on boarding and supply chain review/implementation.

Matt brings a wealth of experience to the team having worked in FMCG International Logistics Industry for 20 years across operational and new business roles at some of the worlds largest freight forwarders. During his successful tenure at those companies Matt has worked across Export/Import operations, eventually working his way up to Operations Management and eventually making his transition into National Business Development Management positions. His unique operational background, combined with his new business implementation skills are going to be of huge value to our new clients and our customer operations team as NEOLINK continues to grow.

About NEOLINK Logistics + Distribution

NEOLINK are a global logistics + distribution business with HQ in Sydney. They offer a full range of logistics and distribution services including air freight, sea freight, customs clearance, warehousing, transport and eCommerce fulfillment.

NEOLINK Announcement – China Extends New Years Holiday to February 2nd to contain Coronavirus – 28.1.20

Monday 28th of January 2020

Good Morning Valued Clients,

Amidst the Coronavirus outbreak; The State Council for the Peoples republic of China has announced it has extended the Lunar New Year Holiday until the February 2nd by one week. (Announcement Attached)

In addition to the above, The Shanghai Municipal government has also announced that it will extend the holiday even further than the rest of China to the 9th of February. This move has been expected as the government and healthcare authorities double down on efforts to contain the virus outbreak by restricting public movement as much as possible.

As such this means that a number of factory and office employees will not be back to work as anticipated, which I am sure is being communicated to you by your suppliers directly.

So what impact does this have on shipping?:

What can NEOLINK and you do?:

Our team will proactively be in contact to discuss the impact and try to ensure we plan to manage this situation as best as we can.

Ultimately these delays are out of everyone’s control and we can try to limit the impact on your business as much as possible.

If you have any questions, please feel free to call any member of the team.

Best regards,

NEOLINK Marketing Team