Dear Valued Customers,

We’re pleased to share our latest Neolink Global Freight Outlook – May 2025, offering a deep dive into the key market shifts, risks, and opportunities shaping global logistics right now.

This is one of the most stable freight pricing periods we’ve seen in four years—yet under the surface, volatility is building. Our team has compiled insights on trade lane performance, economic signals, geopolitical risks, and supply chain strategies to help you navigate the second half of 2025 with clarity and confidence.

🚢 What’s Inside:

📄 Full Report Attached - Neolink Global Freight Outlook - May 2025

💡 Not Yet Using Logixboard?

All Neolink customers receive free access to Logixboard—our real-time visibility and planning platform. If you’re not yet set up, we strongly recommend onboarding. It’s packed with tools for procurement, inventory, and warehouse teams.

We’re happy to schedule 30-minute Logixboard training session for your team. Just reply to this email and we’ll coordinate a time.

Here to Help — And Thank You 🙏

We’re onboarding new customers every week, and if you're navigating uncertainty, facing capacity constraints, or reassessing your global routing strategies—we’re here to help.

If you’re not yet set up on Logixboard, access is completely free and we strongly recommend it. It provides real-time dashboards, PO tracking, and powerful analytics to help you stay ahead. Just let us know, and we’ll gladly arrange a complimentary 30-minute onboarding session to walk you through it.

A special thank you to the many customers who nominated us and provided feedback to the judging panel that helped us win the Australian Financial Review Customer Champion Award. The response has been incredible, and we are extremely grateful for your ongoing support. It’s a privilege to be recognised, and we remain committed to earning that trust every day.

You can read more about our recognition and customer-centric approach in the AFR article below:

AFR Customer Champions 2024: Neolink wins business-to-business category for freight disruptor

For tailored advice, a freight planning session, or a walkthrough of any recent changes, please don’t hesitate to reach out to your Account Manager or contact our team directly.

To speak with someone in our Customer Operations or Business Development team, email us at info@neolink.au or call us on (02) 8363 6565.

Thanks again for your continued support.

Dear Valued Customers,

It is that time of the year again!

As we approach the Brown Marmorated Stink Bug (BMSB) season starting next month, it’s essential to understand how these measures will impact your supply chains.

If your goods are subject to BMSB treatment, additional time needs to be factored into your logistics planning. Given the ongoing challenges such as delays in the Red Sea and transshipment bottlenecks, it's crucial to read this update and understand how these regulations affect your supply chain and how Neolink can assist in mitigating potential disruptions. These seasonal measures are critical to safeguarding Australia's biosecurity and preventing the introduction of this invasive pest.

Please review the below to ensure your business is fully prepared for BMSB Season and also online at The Department of Agriculture’s website:

Where Neolink is arranging the freight movement of your goods we will be working with our overseas partner offices to coordinate treatment with registered and approved treatment providers where applicable.

The full list of approved treatment providers are listed here on The Department of Agriculture’s website

10 Neolink’s Commitment

At Neolink, we recognize the complexities and challenges posed by BMSB regulations. Our experienced team is committed to guiding you through these processes, ensuring your shipments meet all compliance requirements and arrive safely and on schedule. We are dedicated to providing proactive support and tailored solutions to effectively manage these risks.

If you have any questions or need assistance in preparing for the upcoming BMSB season, please feel free to contact your Neolink representative.

Approximately 90% of our customers rely on Neolink to manage their global freight shipments under EXW or FOB terms. If you are importing from a target risk country subject to BMSB measures, we strongly recommend entrusting your global freight to us under these terms to ensure full compliance and efficient handling. If you are arranging shipping through your suppliers or other booking agents, or if you are importing new products that we may not be aware of, please consult with Neolink and our Customs Department for expert guidance before shipping. We are here to help you navigate the BMSB season smoothly.

For detailed information, please refer to the Department of Agriculture, Fisheries, and Forestry website.

Best regards,

Neolink Marketing Team

Dear Valued Clients,

I hope this message finds you well and that the start of the 2024/25 financial year has been successful for everyone.

As always, before we delve into the update, I would like to extend a heartfelt thank you to all of our long-standing customers for their continued trust and support. The feedback we've received on the Neolink Team, Platform, and Services has been overwhelmingly positive, even as we navigate the various challenges affecting global supply chains. To our new customers who joined us this year, we deeply appreciate your confidence in Neolink. I hope you find this market update both informative and insightful, and that it sparks meaningful discussions with our team on how we can further collaborate to enhance the solutions we provide to best serve your business.

In this Global Freight Market Update for H2 2024 we will be covering off the below:

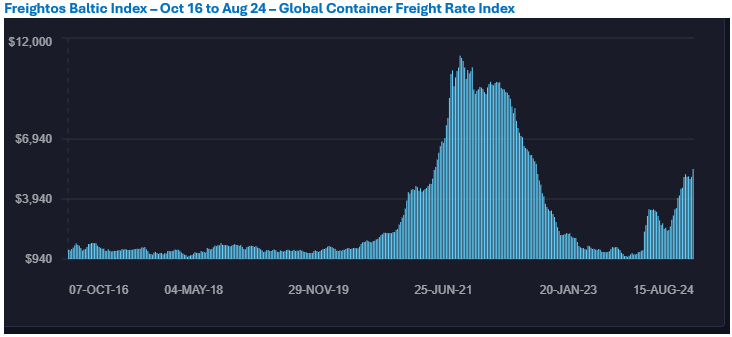

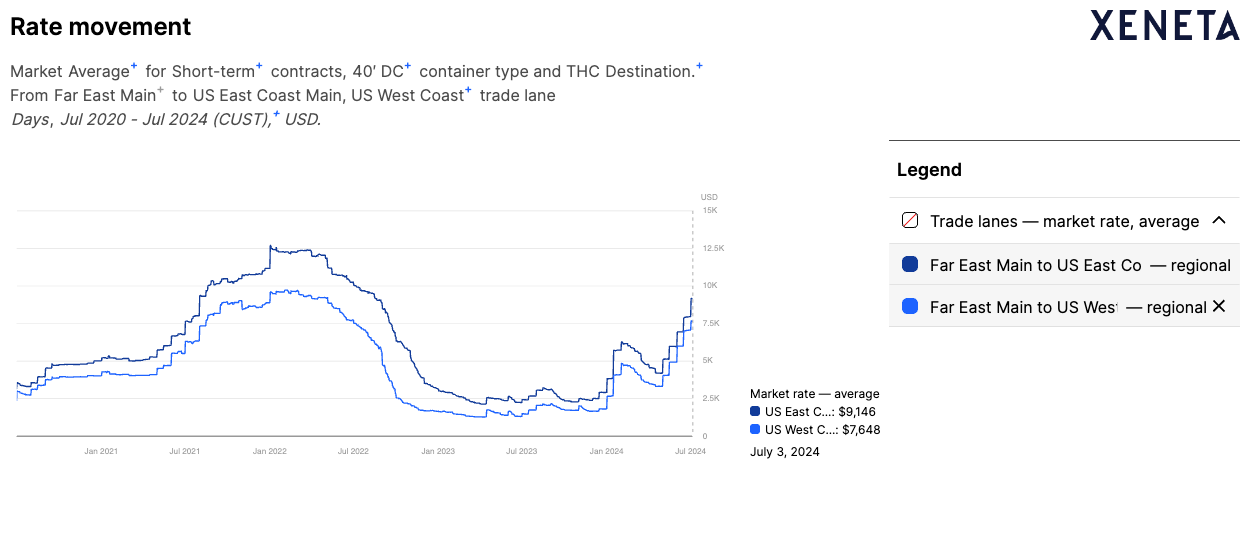

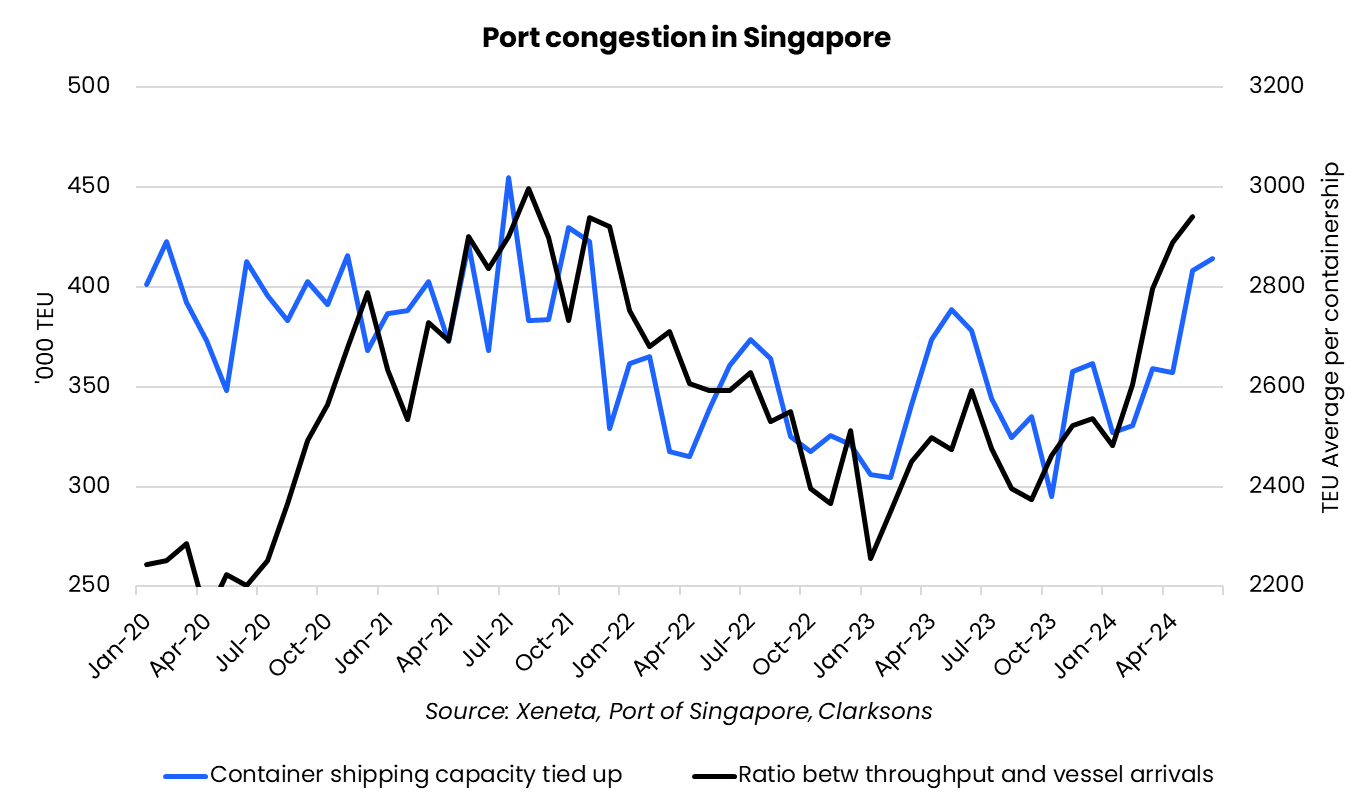

The global container shipping market in 2024 is characterized by significant disruptions and volatility, much of which is driven by geopolitical conflicts, particularly in the Red Sea region. The rerouting of vessels around the Cape of Good Hope due to the Red Sea crisis has added substantial time and cost to shipping operations. This situation is further complicated by congestion at major transhipment hubs like Singapore, Port Klang, and Shanghai, exacerbating delays and increasing costs across the board.

Impact on Freight Rates:

Port Congestion:

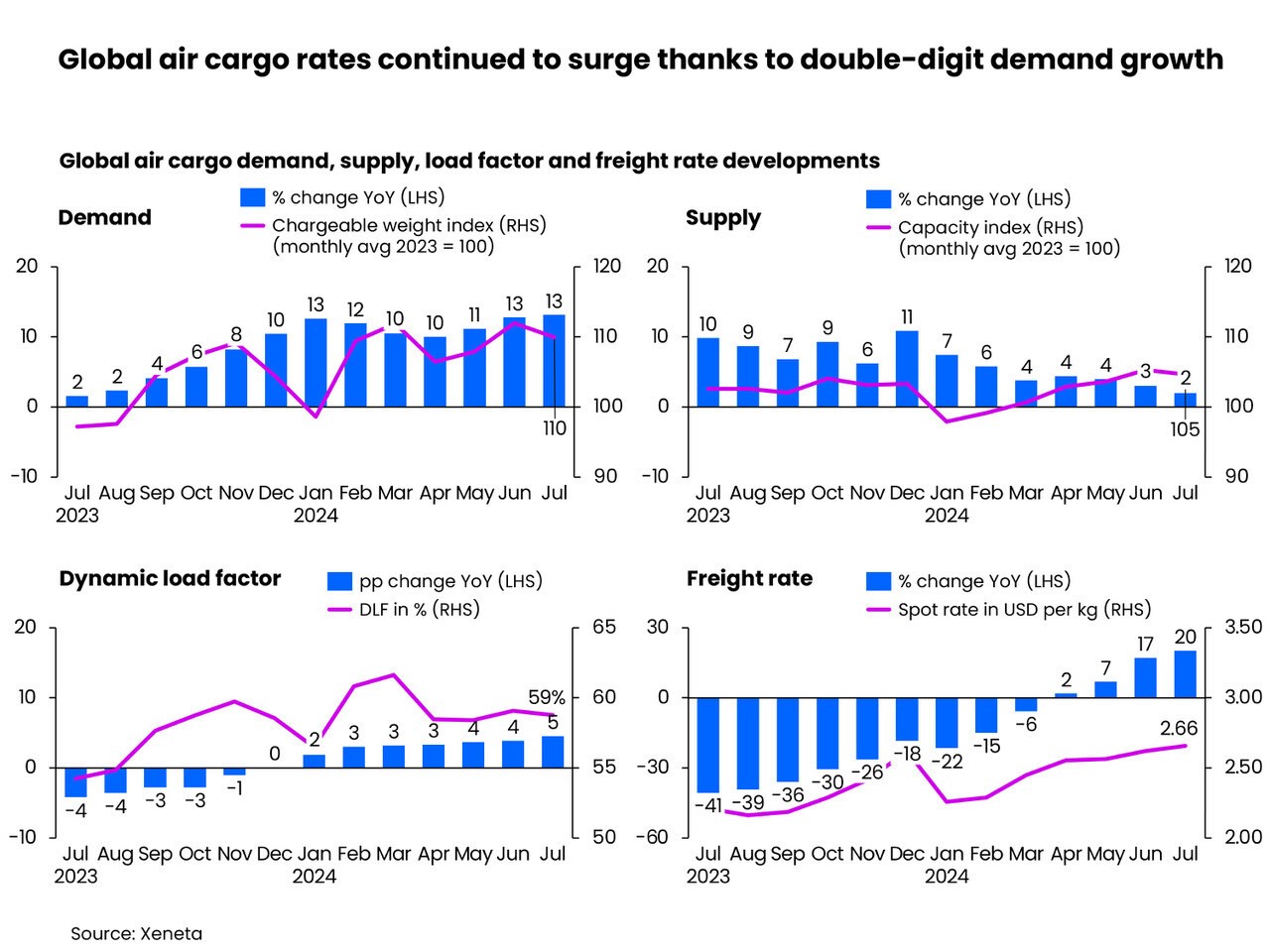

Current Air Freight Market Dynamics

The global air freight market has also been experiencing significant fluctuations and growth throughout 2024, driven by several key factors. As of July 2024 data, global air cargo spot rates have surged to an average of USD 2.66 per kg, reflecting a 20% year-on-year increase. This growth has been underpinned by strong global cargo demand, which rose by 13% year-on-year in July, fuelled largely by robust e-commerce demand from Asia. However, air cargo supply has grown at a much slower pace, with a modest 2% increase year-on-year, leading to an increase in the global dynamic load factor to 59% you will see listed below in Xeneta’s Air Freight data:

The air cargo market has remained resilient, especially in light of disruptions like the global IT CrowdStrike outage in July, which caused temporary but significant delays. Despite these challenges, the market has continued to see rising demand and rates, driven by several regional and global factors, including the ongoing Red Sea disruptions, which have compounded issues in the ocean freight market, pushing more cargo to air freight.

Impact on Australian Importers and Exporters

As global supply chain disruptions continue to impact international trade, Australian importers and exporters face a set of challenges that are exacerbating logistical difficulties and driving up costs. The withdrawal of major carriers from key Australian routes and the subsequent reduction in available shipping capacity have created a highly competitive environment, where securing space on vessels has become increasingly difficult. Additionally, rate increases, and the cancellation of planned vessels have added further pressure, forcing businesses to explore alternative and often more expensive solutions.

Please see specifics below:

Capacity Reduction in the Australian Market

Rate Increases and Space Allocation Issues

Future Outlook

As we move through the remainder of 2024, the global shipping industry is expected to remain volatile, with significant challenges driven by ongoing supply chain disruptions and geopolitical tensions. The rerouting of vessels due to the conflict in the Red Sea has added considerable transit time and costs, straining the global fleet's capacity. Although 2024 is set to witness record deliveries of new container ships, the anticipated relief from this additional capacity may be dampened by persistent port congestion and the need for ships to cover longer routes.

The potential for rate stabilization hinges on the resolution of key geopolitical conflicts, particularly in the Red Sea. Should the situation improve and normal shipping routes through the Suez Canal be restored, the market could experience a rapid increase in available capacity, leading to a possible reduction in freight rates. However, given the uncertainty surrounding these developments, the market is likely to remain unpredictable, with continued pressure on freight costs and capacity availability.

Recommendations for Australian Businesses

Given the challenging outlook, Australian importers and exporters must adopt proactive strategies to navigate the complexities of the current market environment. The following recommendations can help businesses mitigate risks and capitalize on potential opportunities:

Whilst not all of the above strategies or recommendations may be suitable for your business, adopting some of the above strategies has been done by several of our customers with success and positioned themselves better to manage the risks associated with managing the current volatile global shipping market.

As our customers and prospective customers are aware, Neolink is a modern, innovative freight forwarder that combines cutting-edge technology with deep industry expertise to help Australian businesses navigate the above complexities of today’s global supply chains. As a new-age forwarder, we leverage advanced digital platforms like Logixboard, strong carrier relationships, and proactive supply chain strategies to optimize routes, secure better freight rates, and ensure seamless communication and planning with factories. Our tailored solutions are designed to help businesses maintain resilience and competitiveness in an increasingly volatile market.

So how can Neolink assist to best manage the current market dynamics with our customers?:

As we approach the end of 2024, it's important to plan ahead for containers arriving into Australian ports during the Christmas period. We understand that many businesses have closure periods around this time, and we will work closely with you to ensure the right solutions are in place. If your business will be closed for any significant period, please coordinate with your Customer Operations contact at Neolink to ensure that orders and containers are scheduled appropriately.

Below are key dates that may impact your supply chains:

IMPORTANT – SHIPMENTS FROM EUROPE FOR CHRISTMAS

For customers importing from the EU, it’s crucial to consider current market conditions. Neolink’s customers typically have a 3-week order/production cycle. With the present shipping landscape, the average transit time for direct services is approximately 55 days, extending to around 65 days for door-to-door delivery. To ensure your goods arrive in your warehouses by the end of November, please have your orders in our system by close of business on September 6th at the latest. This timeline assumes direct shipping services without transshipment. However, due to ongoing challenges at transshipment ports, we recommend adding an additional 2 to 3 weeks to your planning if a transshipment service is required. For trade routes relying on transshipment services, orders should already be in our system to ensure arrival before December.

IMPORTANT – CHINESE NEW YEAR SHIPMENTS

Regarding the upcoming Chinese New Year, we recommend that all orders needing shipment before the holiday should have EX-Factory dates no later than the second week of January. Typically, Neolink’s customers experience an order/production cycle of 2.5 weeks in China, so we need all such orders entered into our system before the Christmas holidays. This will ensure that your goods depart China before the Chinese New Year shutdown begins.

Please note that the above recommendations for Chinese New Year are based on current market dynamics. Should the situation change, we will promptly communicate any updates to our customers.

As we navigate the complexities of the global freight market in H2 2024, it is clear that the challenges faced by Australian businesses—ranging from increased freight costs to significant supply chain disruptions—are unprecedented in scale and impact, mainly driven by the red sea closure. The global container and air freight markets continue to be shaped by geopolitical tensions, port congestion, and shifting market dynamics. In this environment, agility and strategic planning are more critical than ever.

At Neolink, we are committed to supporting our clients through these turbulent times by offering tailored, proactive solutions that address the specific needs of Australian importers and exporters. Whether it's optimizing supply chain routes, negotiating competitive freight rates, or ensuring seamless communication through advanced digital platforms like Logixboard, our goal is to help you maintain resilience and competitiveness in a volatile market.

We encourage you to reach out to the Neolink team to discuss how we can further assist your business in overcoming the challenges of the current market environment. Together, we can develop strategies that not only mitigate risks but also capitalize on opportunities as they arise.

Thank you for your continued trust in Neolink. We look forward to working closely with you to ensure a successful and prosperous second half of 2024.

Appendix/Sources

Sea trade Maritime News - Hand, M. (2024, July 18). Spot container freight rates surge due to Red Sea crisis. Seatrade Maritime News | Xeneta Ocean Outlook 2024 Sand, P. (2024, July 4). What can stop ocean freight container spot rates reaching pandemic levels? Xeneta | Shipping Market Overview & Outlook | BIMCO. (2024, June). Container Shipping Market Overview & Outlook. BIMCO. | Freight Buyers’ Club Podcast Jensen, L. (2024, August 8). Suez Canal restart won’t solve container shipping turbulence. The Freight Buyers’ Club. Maersk's 2024 Outlook | Taylor, G. (2024, May 3). What Maersk’s 2024 Outlook Says About Container Shipping. Maersk.| DP World AI Innovation DP World. (2024, July 31). How AI can be the game changer for logistics? DP World | Port of Singapore Congestion Taylor, G. (2024, July 5). Singapore Endures More Port Delays as 90% of Container Ships Arrive Late. AFP via Getty Images. | Australian Supply Chain Issues Rabe, T., & Wiggins, J. (2024, July 10). Shipping crises ‘spanner in works for inflation fight. Financial Review.| ABC News on Shipping Costs Ziffer, D. (2024, April 29). Shipping costs on the rise with conflict, pirates, protectionism, and profits sharing the blame. ABC News.| Australian Supply Chain Impact of Red Sea Attacks SBS News. (2024, January 28). Australia’s trade is being threatened by Red Sea cargo ship attacks. SBS News. | Container Port Performance Index S&P Global Market Intelligence & World Bank. (2024, June 6). Container Port Performance Index 2024. World Bank.

Best regards,

Neolink Marketing Team

Neolink Announcement – Red Sea Crisis Update – Impact on Global Trade and Shipping to Australia – 20.12.23

Dear Valued Neolink Customers,

I hope this message finds you well and you are all looking forward to spending some time with your families over the holidays.

We are reaching out to inform you about the recent developments in the Red Sea that may affect your shipments and global trade.

As many of you are aware, the Red Sea region has experienced heightened tensions over the past week, leading to a series of Houthi attacks on shipping vessels navigating through the Suez Canal. These unfortunate events have raised concerns about the safety and efficiency of one of the world's most critical maritime trade routes. Most of the worlds major shipping lines are now rerouting cargo around Africa via the Cape of Good Hope for Safety reasons, but this has inevitably created additional transit times and additional costs for the shipping lines.

At Neolink, we understand the vital role that smooth and secure shipping plays in your business operations. Therefore, we want to provide you with an overview of the current situation and its potential impact on your shipments to and from Australia.

Overview of the Red Sea Crisis:

The ongoing conflict in the Red Sea region has resulted in increased security risks, particularly in the vicinity of the Suez Canal. The Houthi attacks on shipping vessels have prompted heightened security measures and operational challenges for vessels transiting through this strategic waterway.

Impact on Shipping to Australia and Global Trade:

-Potential Delays: Due to the heightened security measures and the need for increased inspections, there may be delays in the transit time of shipments passing through the Suez Canal. This could affect the overall supply chain and delivery timelines.

- Alternative Routes: To mitigate potential disruptions, Neolink is actively exploring alternative shipping routes to ensure the smooth flow of goods to and from Australia on goods that are yet to departing or exporting to the EU. We are working closely with our partners and logistics experts to identify the most efficient and secure alternatives.

- Continuous Monitoring: Our team is closely monitoring the situation and will provide real-time updates as necessary. We remain committed to keeping you informed and minimizing any potential impact on your shipments. I highly recommend to all customers that if you do not have access, to sign up for Logixboard via our website where you can see your shipments on vessels in real time via the platform in addition to Neolink’s customer operations team being available.

What Neolink is Doing:

1.Dedicated Support: Our customer support team is available to address any concerns or queries you may have regarding your shipments. Feel free to reach out to us through the usual channels.

2.Proactive Planning: Neolink is proactively working on contingency plans to ensure that your shipments are routed efficiently, considering the evolving situation in the Red Sea region. If you have an order with us or a shipment already departed that was planned to travel via the Suez from EU, the team will be taking a tailored approach and reaching out to you all one by one. If you have any factory orders that are not in our system or our team are aware of, please reach out to us and let’s plan forward together as best as possible.

In addition to the above, many of you will also be aware of the issues plaguing Australian Ports at the moment due to the Union Strikes and Protected Industrial Action. We have seen the unloading time of vessels increase from 2 days average to 10+ days. Please take this into consideration in addition to the current crisis impacting the Red Sea. If you import from Europe, it is feasible certain shipments could experience some significant delays compared to a normal period where the Suez Canal is not closed, and we did not have Protected Industrial Action across Australia’s Port Terminals.

We understand that these circumstances may raise questions and concerns, but also ultimately create challenges to your supply chain. The team here at Neolink will be working through this time of the year (excluding public holiday) and are proactively this week still reaching out to our customers that are open to ensure we are getting factory orders in time, or planning to air freight where possible on any urgent cargo that could be impacted by these delays.

Rest assured, the entire team here at Neolink is committed to providing transparent communication and finding solutions to minimize any disruptions to your business, but these delays do need to be accounted for within your supply chain and we want to ensure you are empowered to make the best decisions for your business.

Thank you for your understanding and continued trust in Neolink. We will keep you updated on any significant developments and remain at your service for any assistance you may require.

Best regards,

Neolink Marketing Team

Neolink Launches EcoTrack: Revolutionizing Sustainable Logistics with Eco-Friendly Shipping Solutions

Real Time CO2 Monitoring & Offsetting Emissions for Sustainable Logistics

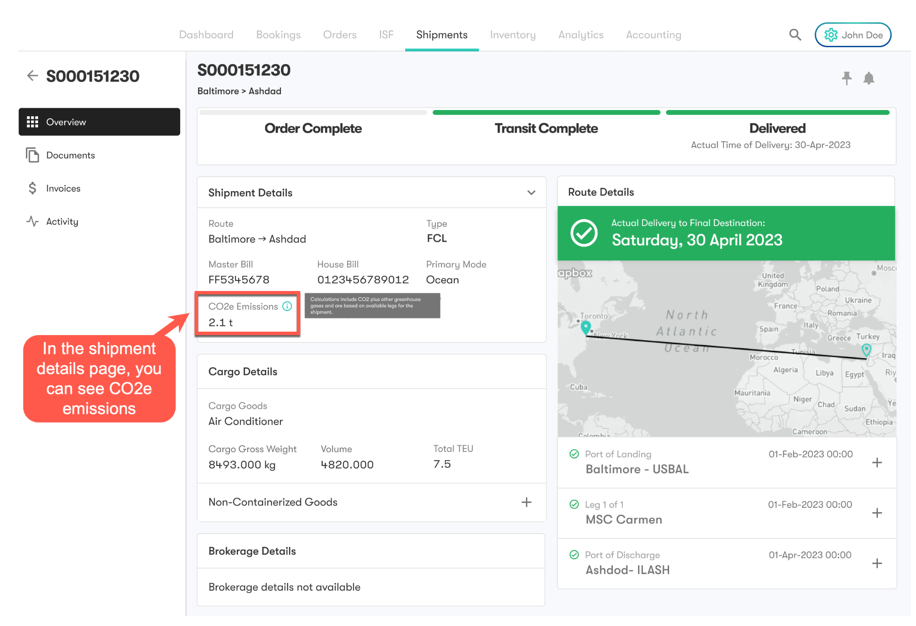

Today Neolink is proud to announce the launch of EcoTrack with our partners, an innovative product within our Logixboard Shipping Platform designed to meet the growing demand for sustainable and environmentally responsible shipping practices.

Consumer Demand & Regulatory Landscape Drive Sustainable Logistics Growth

In response to the surging consumer demand and evolving regulations emphasizing sustainable logistics, Neolink has introduced EcoTrack to empower businesses to monitor and offset their shipment emissions effectively. Recent studies undertaken by AP Moller, Oxford Economics, WWF, and Lune revealed that 86% of supply chain leaders consider a sustainable supply chain a key competitive differentiator. Additionally, 42% of consumers are willing to wait longer for products that are better for the environment. But most importantly that 70% of shippers would offset shipments if this was easily provided through a Logistics Partner.

EcoTrack Features & Benefits

EcoTrack, integrated via Neolink's Logixboard Platform, offers a comprehensive solution for businesses seeking to address their carbon footprint:

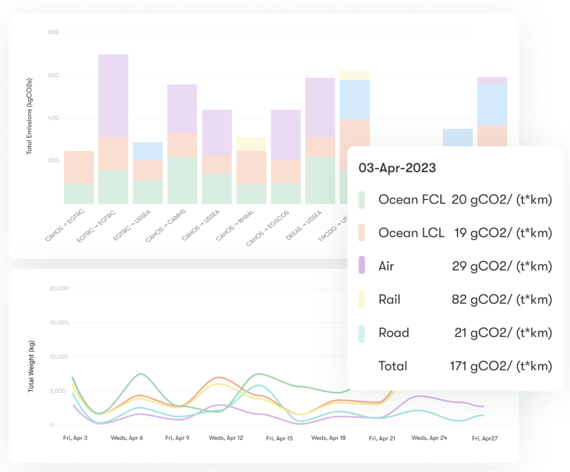

2. Detailed Analytics: Gain access to detailed analytics and emissions impact analysis across the entire supply chain, providing valuable insights into areas for improvement.

3. Compliance and Accreditation: Partnering with Lune, EcoTrack's methodology is compliant with the Global Logistics Emissions Council (GLEC) Framework, ISO 14083, and is audited and accredited by the Smart Freight Centre.

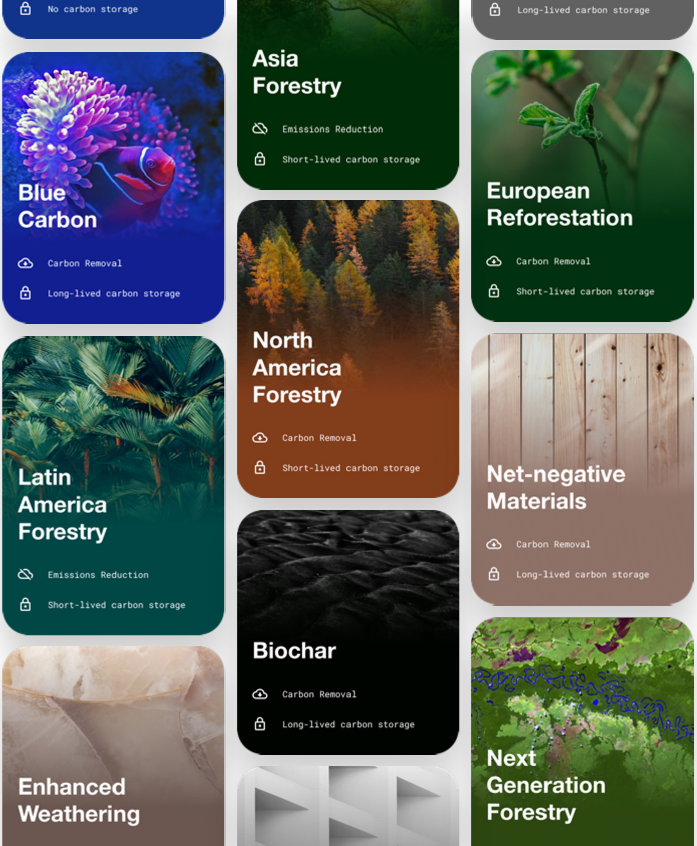

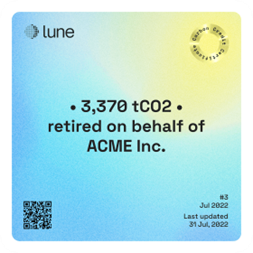

4. Carbon Offset Programs: Neolink enables businesses to understand and reduce their environmental burden by connecting them with high-quality carbon offset programs. Customers can make carbon-neutral shipments the default choice when using Neolink's services.

High-Quality Carbon Offsetting with EcoTrack

EcoTrack distinguishes itself by offering a curated list of high-quality carbon offsets and innovative carbon removal projects from around the world. The projects are meticulously vetted through in-house analysis and external evaluations to ensure their credibility and effectiveness in mitigating environmental impact.

Taking Action with High-Quality Carbon Offsetting

By choosing EcoTrack, Neolink customers can take meaningful action to offset their emissions responsibly. As an example, for just $12 USD, a container shipment from Shanghai to Rotterdam can be made carbon neutral using Forest Conservation Projects. This initiative is certified through the Verified Carbon Standard, providing transparency and credibility.

Making Sustainable Shipping the Default Choice

Neolink encourages businesses to make sustainable shipping the default choice by utilizing EcoTrack. The platform facilitates not only carbon monitoring but also proactive steps toward reducing the environmental impact of logistics operations.

For more information on EcoTrack and how Neolink can help your supply chain transform logistics into a sustainable endeavour, please feel free to contact our commercial team at sales@neolink.au or your Neolink representative.

About Neolink

Neolink are a New Age Global logistics and Supply Chain company, catering to the dynamic needs of Australian Importers and Exporters. Our comprehensive services span global air and sea freight, customs clearance, efficient warehousing, sustainable shipping, and specialized eCommerce support. Since being established in 2017, Neolink has rapidly become one of Australia's fastest-growing companies, recognized on prestigious lists such as the Smart 50 (2021, 2022), AFR Fast Starters (2021), AFR Fast 100 (2022), Deloitte Tech 50 (2022), and Business News Australia’s Australian Young Entrepreneur of the Year for Service Providers (2022). Our pride lies not just in industry accolades but also in being acknowledged by Great Places to Work® as one of Australia's Best Workplaces™️ in 2022. At Neolink, we are more than logistics; we are a team committed to innovation, customer satisfaction, and redefining industry standards.

Neolink Announcement – DP World Cyber Attack, Ports Slowly Begin to Reopen – 13.11.23

Dear Valued Clients,

Good Morning and Hope you all had good weekends.

As most of you may have seen in the mainstream news over the weekend, DP World Australia detected a Cyber Attack last Friday.

For those of you that may not be aware, DP World are one of key terminal operators across Australia’s ports controlling approximately 50% of the container volume that comes in and out of Australia. As such, DP World has since engaged a number of cyber security experts and government bodies/authorities to help them address the incident. The main action that they took on Friday way to shut down landside access to their terminals and thus cancelling pick up slots from transport providers, effectively not allowing customers to collect their cargo.

However, this morning we have been made aware by the Freight & Trade Alliance (FTA) & Container Transport Alliance Australia (CTAA) our industry bodies that some services have started to slowly resume in Brisbane and Melbourne, releasing some slots for container bookings. In addition, some of our Transport Managers have slowly started providing us with information that slots are also now being slowly released for Sydney Import collections only.

Our next steps as your Supply Chain Partner in the coming day/s and week/s ahead:

As you will all be aware from our last announcement, DP World are still going through the negotiations of a new collective bargaining agreement with the CFMEU, and we have already seen multiple vessels omit ports and offload cargo in other cities (as is their rights as per their bill of lading/terms and conditions) if the terminals cannot guarantee certain minimum turn around times for their vessels.

At this point, it is difficult to understand the degree to which this incident over the past few days is going to have on the port efficiencies as we head into Christmas or what action the shipping lines will be taking in the weeks ahead, but our belief is it won’t be a positive one and there is going to be disruption as we head into December.

You will be hearing proactively from our team in the coming day/weeks ahead and ensuring you are well equipped with all the information possible to make the best decisions for your supply chain as we head into the festive season.

If you have any questions, please feel free to reach out to your Neolink representative.

Best regards,

Neolink Marketing Team

Updated Neolink Terms & Conditions - 10.11.23

Neolink Logistics & Distribution Pty Ltd - (ABN - 65 614 643 4543) has recently updated its:

Copies of the new documents are attached to this post and are provided to all new customers prior to engaging with Neolink.

Neolink require all customers to sign our credit application & accept our terms of service before we commenced trading.

The new T&Cs will take effect from this date and will apply to all services provided after that time.

If you have any questions, please feel free to reach out to your Neolink Representative.

Best regards,

Neolink Marketing Team

Neolink Announcement – Brown Marmorated Stink Bug (BMSB) Seasonal Measures 2023 to 2024 – 30.8.23

Dear Valued Clients,

We hope this message finds you well.

As a trusted global freight forwarder serving Australian importers and exporters, we are committed to keeping you informed about critical updates affecting your shipments.

With the new season rapidly approaching, we want to ensure you are aware of the latest developments regarding the Brown Marmorated Stink Bug (BMSB) seasonal measures (all information below is also on the Department of Agriculture’s BMSB Resource Hub)

What's New for the 2023-2024 Season:

BMSB Seasonal Measures Overview:

BMSB Measures for Goods:

Treatment of Target High-Risk Goods:

Containerized Goods (FCL, FCX):

Break Bulk Goods:

LCL and FAK Containers:

Known Risk Pathways and Supply Chains:

Treatment in Australia and New Zealand:

Target Risk Countries:

The following countries are classified as target risk (as of 30.8.23):

Albania

Andorra

Armenia

Austria

Azerbaijan

Belgium

Bosnia and Herzegovina

Bulgaria

Canada

Croatia

Czechia

France

Japan (heightened vessel surveillance only).

Georgia

Germany

Greece

Hungary

Italy

Kazakhstan

Kosovo

Liechtenstein

Luxembourg

Montenegro

Moldova

Netherlands

Poland

Portugal

Republic of North Macedonia

Romania

Russia

Serbia

Slovakia

Slovenia

Spain

Switzerland

Türkiye

Ukraine

United States of America

Uzbekistan (new)

The following countries have been identified as emerging risk countries for the -BMSB risk season and may be selected for a random onshore inspection:

United Kingdom and China

China – random inspections will apply to goods shipped between 1 September to 31 December (inclusive)

United Kingdom – random inspections will apply to goods shipped between 1 December to 30 April (inclusive)

In addition to the target high risk goods, chapters 39, 94 and 95 will be subject to random inspections for emerging risk countries only.

Emerging Risk Countries:

Emerging risk countries include the United Kingdom and China, with random inspections during specific timeframes.

Target Goods Subject to Measures:

Measures for Vessels:

Approved BMSB Treatment Options:

Three treatment options are available: Heat, Methyl Bromide, and Sulfuryl Fluoride. (BMSB Resource Hub Link for full list)

Treatment Minimum Standards:

Providers must adhere to minimum standards to ensure effective treatment.

Onshore and Offshore Treatment Providers:

Treatment providers in target risk countries must be registered and 'approved. (BMSB Resource Hub Link for full list)

Neolink does not have single set approach to BMSB Season for all of our customers, this is done on a customer-by-customer basis depending on the supply chain you run and as such we may present/recommend different solutions accordingly.

Our team will be proactively reaching out to customers that import from target risk countries and even countries that are emerging risk to warn of the challenges that may be incurred from random inspections during this period. We highly recommend to all of our customers that they allow for some time within their supply chains to account for either origin/destination fumigation and random inspections being incurred if your company imports commodities from countries that fall into any of the key categories above.

Neolink and all of our team members are here to work with you during this period and ensure your supply chains adhere to the government’s requirements, as well as limit as much as possible the disruption to your business.

If you have any questions surrounding the BMSB period, please feel free to contact your Customer Operations Coordinator or your Business Development Manager.

Best regards,

Neolink Marketing Team

Neolink Announcement – Carriers Planning To Take Action on China to Australia Trade Lane Shipping – 8.5.23

Monday 8th of May 2023

Dear Valued Clients,

We hope this message finds you well.

As a Freight Forwarder and your Global Supply Chain Partner, we understand the importance of timely and reliable shipping services, and we are committed to keeping you informed about the current developments in the China to Australia trade lane

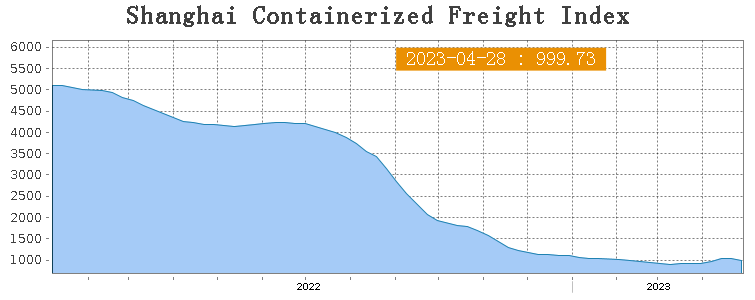

As you are aware, the first quarter of this year brought some relief from high freight rates and low schedule reliability. The Shanghai Container Freight Index (USD/TEU), which tracks all export sea freight rates from the world's busiest container port, demonstrates how far rates have fallen since the beginning of 2022 to now, with overall rates at less than 20% of what they were during the height of COVID.

See below (source: SCFI):

However, this has led to the lowest freight rates from China to Australia in a very long time, and now rates are well below 2019 freight rates. This is due to an increase in supply of new capacity entering the market, such as new vessels, services, and empty containers, followed by a drop in demand "post-COVID" due to inflationary pressures that most economies are now facing.

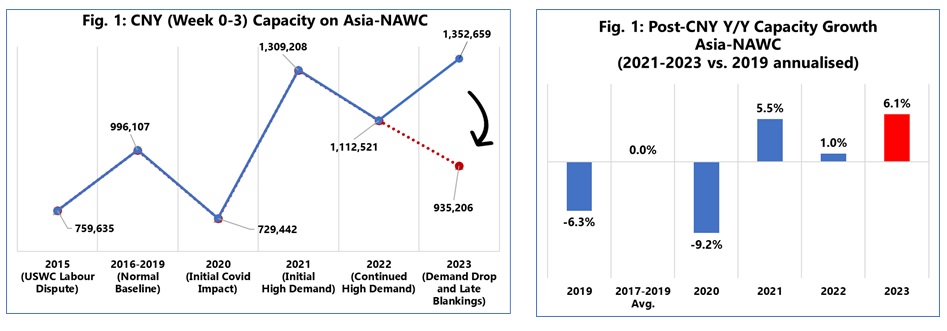

See below (source: Sea Intelligence):

Currently, it costs more money to pay the ports in Australia to remove the cargo from the vessel and make it available for collection from the wharf (Destination Port Charges on your invoices) than it costs to ship a container from China to Australia. While we understand that many in the industry may be pleased with the low freight rates, the shipping lines are doing everything they can to increase the price of the freight rates, especially on the CN to AU Trade Lane, which is well below break-even for any shipping line carrying cargo to Australia from China.

Due to all of the above factors, the shipping lines are doing everything within their control to increase their prices by utilising the supply side of the equation. As a result, they are planning to take some real action on upcoming sailings as we head into May. Our China Branch Office informed us late last week via their Procurement Department, which deals with the shipping lines in China on all of our contracts to Australia, that the carriers are planning to cancel or "blank" sailings coming to Australia earlier over the coming weeks.

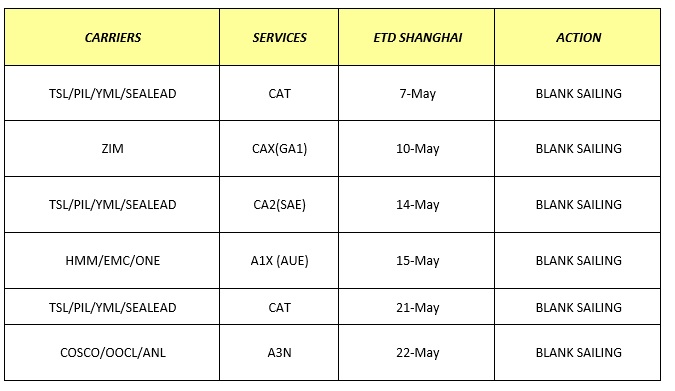

Please find below sailings that are being planned to be cancelled by all carriers. Since all vessels are calling into Shanghai, they might come from Qingdao and then go to Shenzhen. This impacts most vessels/services coming to Australia:

This is the biggest scale of action we have seen for many years with regards to blank/cancelled sailings on the CN to AU Trade Lane. This is on top of the fact that A3X and CA3 services were totally removed from the market earlier in the year.

The belief from the shipping lines is that if the market isn't pushed up after these actions, carriers will do more blank sailings like they have in CN-EU and CN-US, and CN to other trade lanes. Further to the information we have received on the blank sailings, we are also being informed by most of the shipping lines that they are planning to introduce a “Rate Restoration surcharge” USD250.00/USD500.00 PER 20GP/40HQ from China to Australia with effective date 21 May 2023.

If you have any orders with us currently waiting to be shipped in May your Customer Operations Coordinator or Business Development Manager will be in contact if it has been impacted by the above cancelled sailings.

Just like we did during the COVID period our team will work with you proactively to look at other options and seek our alternatives where feasible to keep you cargo moving – all of which will be updated in our Digital Logixboard Platform.

However, we cannot do that if we do not have your orders in our system – if you have anything in production in China that is ready in May and we are not aware, please let us know.

We can be proactive in providing different options and solutions to help best navigate the above cancelled sailings if we have advanced notice of more than a week on goods readiness.

If you have any questions at all about any of the above, please feel free to also call any member of the Operations and Business Development Team.

Best regards,

Neolink Marketing Team

Cosco RR notification from North East Asia to Australia -Effective from 21st May. 2023

OOCL Customer Advisory - Rate Restoration - North East Asia to Australia Trade - 22nd May 2023

Neolink End of Year Supply Chain Update

Friday 21st of October 2022

Dear Valued Clients,

I hope you are all well and 2022 has been better than the past couple of years.

Before we get into the update, I want to say a big thank you to you all for your continued support not just the past 12 months, but also for some over the past five years as we have grown the Neolink business – thank you again!

In this End of Year Supply Chain Update we will be covering off the below:

Global Freight Rate and Manufacturing Update

As most of you are aware, Freight rates globally have been dropping since the beginning of January and have more progressively been heading towards the $1,500 per 20 / $3,000 per 40 mark on the FBX Index for the FAK Spot market.

See below:

https://fbx.freightos.com/

Despite the drop in freight rates, we are still significantly above where the market was pre-covid and the AUD taking a hit on the USD has found it hard to slow the impact on inflation across a number of industry sectors. As all of our existing and new customers are aware, Neolink FAK rates move with the market across all trade lanes and most of you will be seeing your rates dropping on new quotations every week, as well as invoices on current shipments. Please be aware however that if you do have invoices hitting your inbox now that this is based on freight rates at the time of departure and in a lot of instances depending on the port of loading, rates could have moved significantly since that time. If you have any questions on current market pricing, please contact your Customer Operations Coordinator or relevant Business Development Manager.

Also please note that Neolink holds USD and EUR accounts and are able to generate invoices in these currencies to assist with everyone’s FX hedging strategies.

Freight rates have been dropping mainly due to a couple of key reasons globally: firstly, being the increase in more vessels and services hitting the market as container volumes soften globally – please see below:

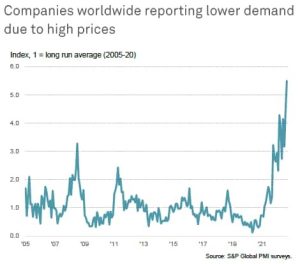

The second key driver has been the softening in container demand as global manufacturing has fell for the first time since August 2020 according to the global manufacturing PMI and which in turn is being driven by inflation globally:

The million-dollar question for everyone is at what point will demand hold and where will freight rates finish as we see central banks around the world continue to increase interest rates. What is masking a lot of the freight rate movements at the moment will be end of year planning for a lot of importers and exporters as we head into the Christmas period, which everyone is forecasting will be “softer” than previous years.

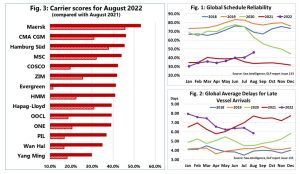

Sea Freight Sailing Reliability and Delay Updates to AU/NZ

Since the beginning of this year, we have steadily seen carrier performance and global schedule reliability slowly improve up to just under 50% as we see the market start to somewhat normalise. That being said this does still mean that over 50% of sailing schedules are not on time and in addition to that we are still seeing vessels arrive with delays of still 6 days during transit times alone – although this has also improved since the beginning of the year. This is without considering any of the delays on berthing at the terminals and in still quite a few instances we are seeing vessels taking longer to move through ports, or still rotating at the last minute which can blow out ETA’s out by up to two weeks in some instances from Asian ports.

Neolink have contracts at origin and destination with all of the major shipping lines – our priority is to always ensure our customers have a range of different options whether it be paying a premium/direct service or cheaper/longer transit options.

All in all, we are seeing all of the major shipping lines improving in their schedule reliability, albeit still significantly behind pre covid times.

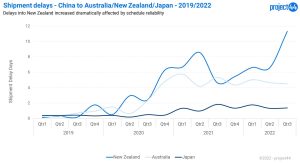

With regards to New Zealand the issue is much more challenging due to a number of key reasons. In June of this year two workers died on the ports in April due to a workplace accident and this has resulted in heightened safety regulations impacting port productivity. In addition, we are seeing that shipping lines as a result are running extremely behind schedule with delays into NZ due to the congestion and this is the worst it has been since the COVID Pandemic began – please see below P44 delay update:

End of Year & Chinese New Year Planning

Despite all of the above lingering market challenges that occur across all aspect of the supply chain; we still do have things that we can control.

One of those things is the Order Management Process and how we pre-plan/coordinate the supply chain proactively with your overseas suppliers that can help us in reducing the risk/navigating the market conditions with your shipments.

Recently we completed a full analysis across the past three years across 10,000 + shipments and this is what we learned:

All of the above gives us more time to plan with your factories and allow our origin offices more time to book space typically on quicker/direct services that are in higher demand when earlier notice is provided. For all of our customers that still do not have Christmas orders into our system, I ask that you please reach out to us and share them with our team, in addition our team are proactively reaching out to our customers everyday about your orders anyway. If anything, urgent does come in, please highlight this to the relevant team member for us to assist over the Christmas period as our team will be working excluding the public holidays.

Although it seems some time away; Chinese New Year is falling in 2023 on Sunday January 2022 and will be starting the year of the rabbit commencing traditionally 16 days of celebrations lasting until the Lantern Festival on February 5th, 2023. As office closure periods etc are announced we will certainly be updating you and making you aware, we understand some of your suppliers might be closing production earlier or later so please keep us in the loop.

Despite the market improving, we are still experiencing delays at terminals and transit times, so please keep this in mind for CNY to avoid delays ideally, we would like to have cargo ready by the end of the first week of January to ensure we do our best to risk mitigate delays/challenges with shipping.

Your respective Business Development Manager, Customer Operations Team or one of our GM’s will be speaking to you in the coming weeks regarding CNY for all of those respective clients.

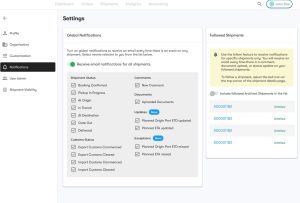

New ETA/ETD Email Notifications on Neolink Logixboard

To those customers of ours that do not currently use Neolink Logixboard I strongly advise that you sign up and find out more from your Customer Operations or BDM. The platform is free of charge to all of our customers and has some amazing functionality to not only track your shipments, but see live vessel GPS data, plan your factory orders and have your accounts team find all of the relevant shipment documentation – for general info please feel free to find more info on our site: https://neolink.au/neolink-logixboard/

More and more functionality is coming to this platform – so please feel free to provide feedback as this allows us to provide feedback to the R&D Team that are constantly looking to improve its features and functionality.

NEW this month to Neolink LogixBoard is Automated Email Notifications for planned ETA/ETD changes on your shipments.

In order to enable the notifications please follow the below instructions

Settings —> Notifications

The new notifications we add will be turned off by default.

To receive these email notifications:

Navigate to Settings, then click on Notifications

Tick the box next to the notifications you want to subscribe to.

Being transparent is extremely important for everything that we do here at Neolink and providing access to all of this information is critical to ensuring our customers can act according to the most up to date information possible. That being said, please be aware that in a lot of instances you will be finding out via automated updates based on shipping line data – some of the time we may be aware of a delay before the shipping line and update you accordingly or alternatively may occur without any notification at all from the shipping line. In the event this does occur your Customer Operations contact will endeavour to find out more information and ascertain cause, impact, and provide you with more detail as quickly as we possibly can.

Once again, thank you to everyone for your support to date and if you have any questions, please feel free to reach out to your relevant Neolink contact.

Best regards,

Neolink Marketing Team