Dear Valued Clients,

I hope this message finds you well and that the start of the 2024/25 financial year has been successful for everyone.

As always, before we delve into the update, I would like to extend a heartfelt thank you to all of our long-standing customers for their continued trust and support. The feedback we've received on the Neolink Team, Platform, and Services has been overwhelmingly positive, even as we navigate the various challenges affecting global supply chains. To our new customers who joined us this year, we deeply appreciate your confidence in Neolink. I hope you find this market update both informative and insightful, and that it sparks meaningful discussions with our team on how we can further collaborate to enhance the solutions we provide to best serve your business.

In this Global Freight Market Update for H2 2024 we will be covering off the below:

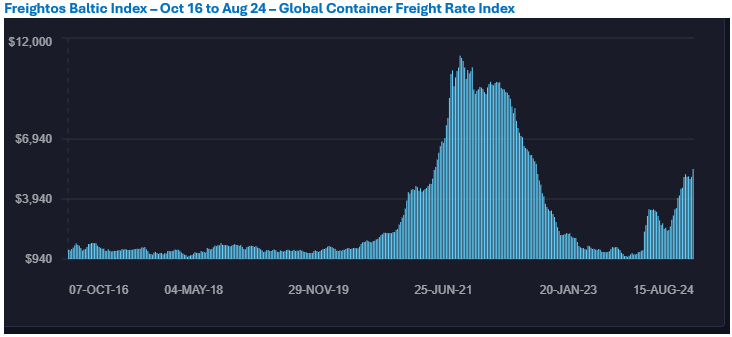

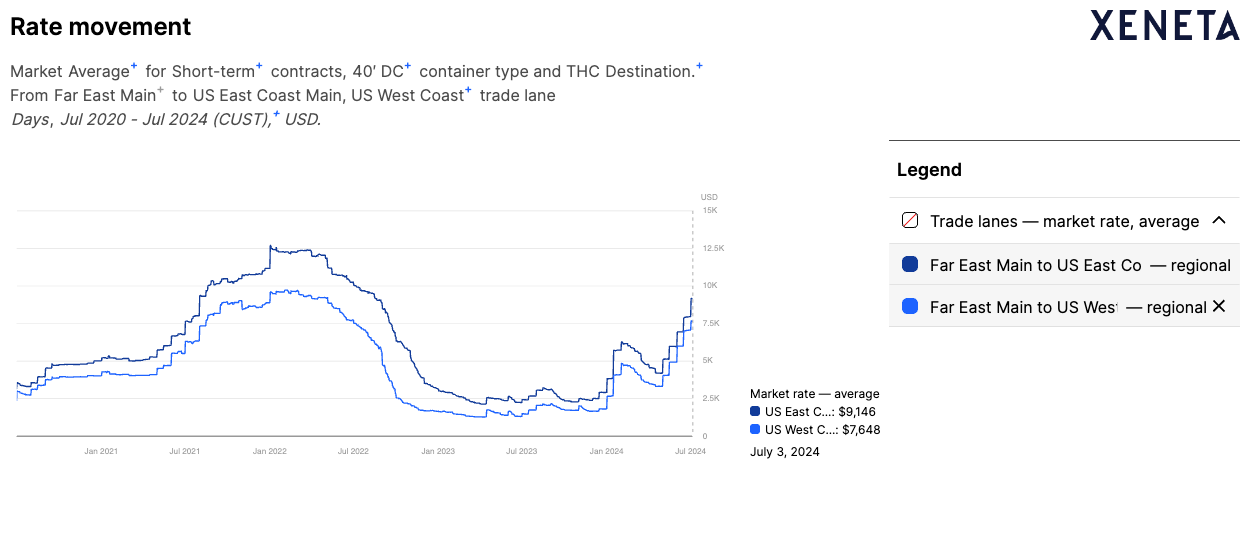

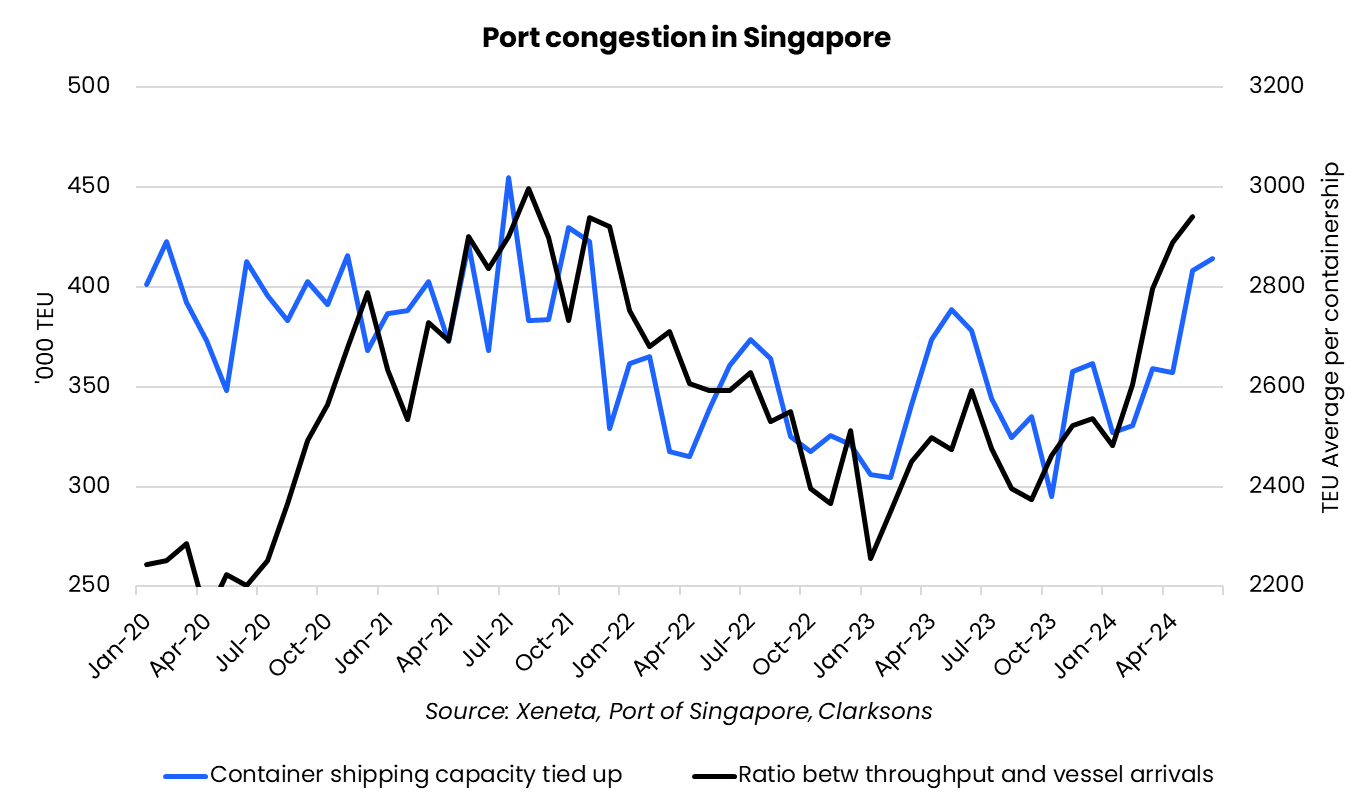

The global container shipping market in 2024 is characterized by significant disruptions and volatility, much of which is driven by geopolitical conflicts, particularly in the Red Sea region. The rerouting of vessels around the Cape of Good Hope due to the Red Sea crisis has added substantial time and cost to shipping operations. This situation is further complicated by congestion at major transhipment hubs like Singapore, Port Klang, and Shanghai, exacerbating delays and increasing costs across the board.

Impact on Freight Rates:

Port Congestion:

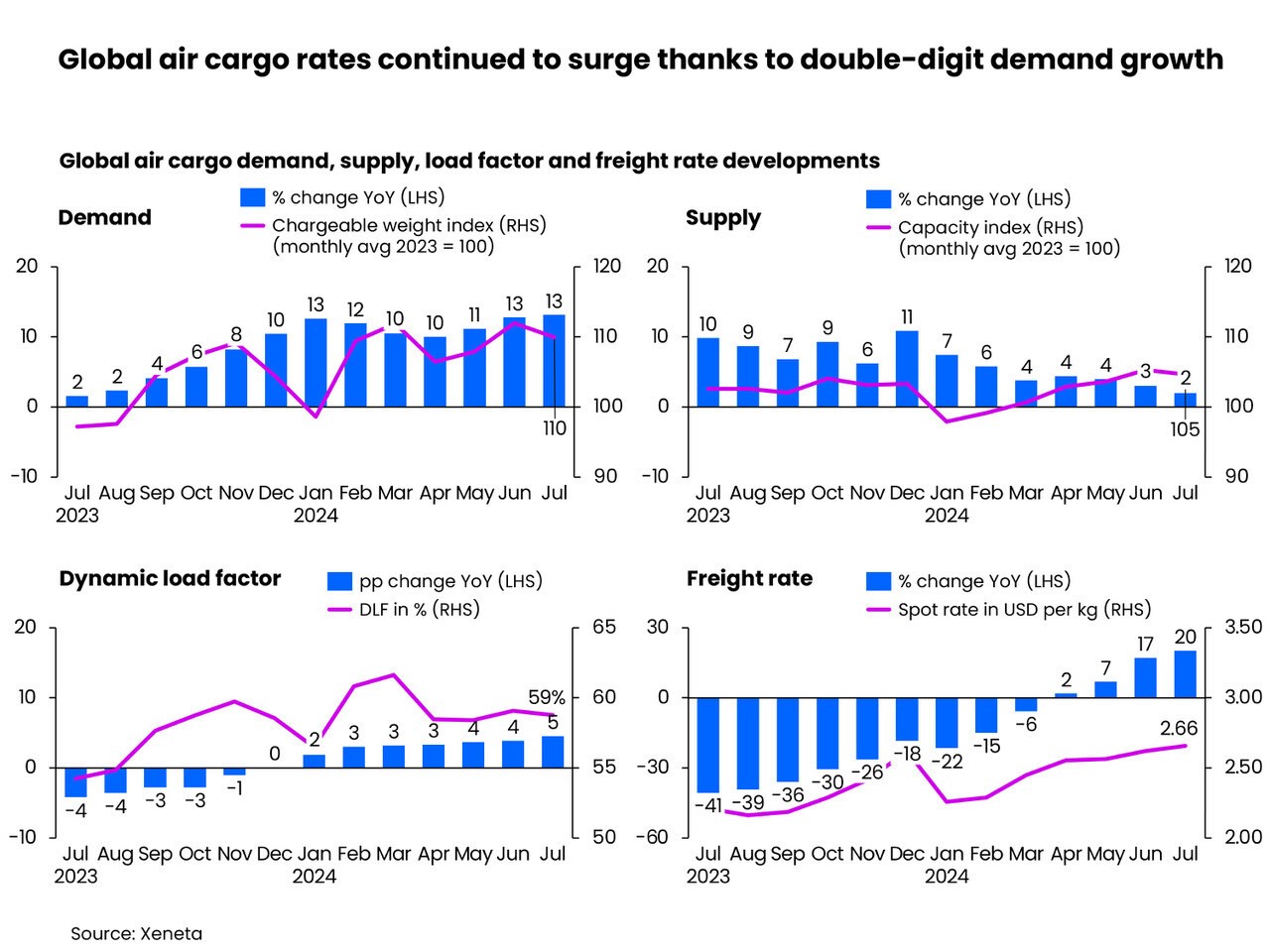

Current Air Freight Market Dynamics

The global air freight market has also been experiencing significant fluctuations and growth throughout 2024, driven by several key factors. As of July 2024 data, global air cargo spot rates have surged to an average of USD 2.66 per kg, reflecting a 20% year-on-year increase. This growth has been underpinned by strong global cargo demand, which rose by 13% year-on-year in July, fuelled largely by robust e-commerce demand from Asia. However, air cargo supply has grown at a much slower pace, with a modest 2% increase year-on-year, leading to an increase in the global dynamic load factor to 59% you will see listed below in Xeneta’s Air Freight data:

The air cargo market has remained resilient, especially in light of disruptions like the global IT CrowdStrike outage in July, which caused temporary but significant delays. Despite these challenges, the market has continued to see rising demand and rates, driven by several regional and global factors, including the ongoing Red Sea disruptions, which have compounded issues in the ocean freight market, pushing more cargo to air freight.

Impact on Australian Importers and Exporters

As global supply chain disruptions continue to impact international trade, Australian importers and exporters face a set of challenges that are exacerbating logistical difficulties and driving up costs. The withdrawal of major carriers from key Australian routes and the subsequent reduction in available shipping capacity have created a highly competitive environment, where securing space on vessels has become increasingly difficult. Additionally, rate increases, and the cancellation of planned vessels have added further pressure, forcing businesses to explore alternative and often more expensive solutions.

Please see specifics below:

Capacity Reduction in the Australian Market

Rate Increases and Space Allocation Issues

Future Outlook

As we move through the remainder of 2024, the global shipping industry is expected to remain volatile, with significant challenges driven by ongoing supply chain disruptions and geopolitical tensions. The rerouting of vessels due to the conflict in the Red Sea has added considerable transit time and costs, straining the global fleet's capacity. Although 2024 is set to witness record deliveries of new container ships, the anticipated relief from this additional capacity may be dampened by persistent port congestion and the need for ships to cover longer routes.

The potential for rate stabilization hinges on the resolution of key geopolitical conflicts, particularly in the Red Sea. Should the situation improve and normal shipping routes through the Suez Canal be restored, the market could experience a rapid increase in available capacity, leading to a possible reduction in freight rates. However, given the uncertainty surrounding these developments, the market is likely to remain unpredictable, with continued pressure on freight costs and capacity availability.

Recommendations for Australian Businesses

Given the challenging outlook, Australian importers and exporters must adopt proactive strategies to navigate the complexities of the current market environment. The following recommendations can help businesses mitigate risks and capitalize on potential opportunities:

Whilst not all of the above strategies or recommendations may be suitable for your business, adopting some of the above strategies has been done by several of our customers with success and positioned themselves better to manage the risks associated with managing the current volatile global shipping market.

As our customers and prospective customers are aware, Neolink is a modern, innovative freight forwarder that combines cutting-edge technology with deep industry expertise to help Australian businesses navigate the above complexities of today’s global supply chains. As a new-age forwarder, we leverage advanced digital platforms like Logixboard, strong carrier relationships, and proactive supply chain strategies to optimize routes, secure better freight rates, and ensure seamless communication and planning with factories. Our tailored solutions are designed to help businesses maintain resilience and competitiveness in an increasingly volatile market.

So how can Neolink assist to best manage the current market dynamics with our customers?:

As we approach the end of 2024, it's important to plan ahead for containers arriving into Australian ports during the Christmas period. We understand that many businesses have closure periods around this time, and we will work closely with you to ensure the right solutions are in place. If your business will be closed for any significant period, please coordinate with your Customer Operations contact at Neolink to ensure that orders and containers are scheduled appropriately.

Below are key dates that may impact your supply chains:

IMPORTANT – SHIPMENTS FROM EUROPE FOR CHRISTMAS

For customers importing from the EU, it’s crucial to consider current market conditions. Neolink’s customers typically have a 3-week order/production cycle. With the present shipping landscape, the average transit time for direct services is approximately 55 days, extending to around 65 days for door-to-door delivery. To ensure your goods arrive in your warehouses by the end of November, please have your orders in our system by close of business on September 6th at the latest. This timeline assumes direct shipping services without transshipment. However, due to ongoing challenges at transshipment ports, we recommend adding an additional 2 to 3 weeks to your planning if a transshipment service is required. For trade routes relying on transshipment services, orders should already be in our system to ensure arrival before December.

IMPORTANT – CHINESE NEW YEAR SHIPMENTS

Regarding the upcoming Chinese New Year, we recommend that all orders needing shipment before the holiday should have EX-Factory dates no later than the second week of January. Typically, Neolink’s customers experience an order/production cycle of 2.5 weeks in China, so we need all such orders entered into our system before the Christmas holidays. This will ensure that your goods depart China before the Chinese New Year shutdown begins.

Please note that the above recommendations for Chinese New Year are based on current market dynamics. Should the situation change, we will promptly communicate any updates to our customers.

As we navigate the complexities of the global freight market in H2 2024, it is clear that the challenges faced by Australian businesses—ranging from increased freight costs to significant supply chain disruptions—are unprecedented in scale and impact, mainly driven by the red sea closure. The global container and air freight markets continue to be shaped by geopolitical tensions, port congestion, and shifting market dynamics. In this environment, agility and strategic planning are more critical than ever.

At Neolink, we are committed to supporting our clients through these turbulent times by offering tailored, proactive solutions that address the specific needs of Australian importers and exporters. Whether it's optimizing supply chain routes, negotiating competitive freight rates, or ensuring seamless communication through advanced digital platforms like Logixboard, our goal is to help you maintain resilience and competitiveness in a volatile market.

We encourage you to reach out to the Neolink team to discuss how we can further assist your business in overcoming the challenges of the current market environment. Together, we can develop strategies that not only mitigate risks but also capitalize on opportunities as they arise.

Thank you for your continued trust in Neolink. We look forward to working closely with you to ensure a successful and prosperous second half of 2024.

Appendix/Sources

Sea trade Maritime News - Hand, M. (2024, July 18). Spot container freight rates surge due to Red Sea crisis. Seatrade Maritime News | Xeneta Ocean Outlook 2024 Sand, P. (2024, July 4). What can stop ocean freight container spot rates reaching pandemic levels? Xeneta | Shipping Market Overview & Outlook | BIMCO. (2024, June). Container Shipping Market Overview & Outlook. BIMCO. | Freight Buyers’ Club Podcast Jensen, L. (2024, August 8). Suez Canal restart won’t solve container shipping turbulence. The Freight Buyers’ Club. Maersk's 2024 Outlook | Taylor, G. (2024, May 3). What Maersk’s 2024 Outlook Says About Container Shipping. Maersk.| DP World AI Innovation DP World. (2024, July 31). How AI can be the game changer for logistics? DP World | Port of Singapore Congestion Taylor, G. (2024, July 5). Singapore Endures More Port Delays as 90% of Container Ships Arrive Late. AFP via Getty Images. | Australian Supply Chain Issues Rabe, T., & Wiggins, J. (2024, July 10). Shipping crises ‘spanner in works for inflation fight. Financial Review.| ABC News on Shipping Costs Ziffer, D. (2024, April 29). Shipping costs on the rise with conflict, pirates, protectionism, and profits sharing the blame. ABC News.| Australian Supply Chain Impact of Red Sea Attacks SBS News. (2024, January 28). Australia’s trade is being threatened by Red Sea cargo ship attacks. SBS News. | Container Port Performance Index S&P Global Market Intelligence & World Bank. (2024, June 6). Container Port Performance Index 2024. World Bank.

Best regards,

Neolink Marketing Team