NEOLINK Listed as One of Australia’s Fastest Growing Start-ups – AFR Fast Starters 2021

Monday 29th of November 2021

NEOLINK are today extremely proud to announce we have been listed on the Australian Financial Review’s 2021 Fast Starters List.

We would like to thank all of our employee’s, customers and suppliers that have played a key role in helping navigate the current global shipping climate. Without everyone’s support we would not have been able to make it on this list and we wanted to celebrate this success with you all.

NEOLINK debuted on the Fast Starters List in position #39 – please see the full list on the Australian Financial Reviews Site:

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Nationwide Port Strikes Perfectly Timed in the Build Up to Christmas – 27.9.21

Monday 27th of September 2021

Dear Valued Clients,

Some of you have proactively reached out to me this morning regarding mainstream news about nationwide port strikes.

Whilst we do not have all the details; we can confirm that the Maritime Union of Australia has issued 40 new industrial action notifications across a number of ports and terminals that will start to take affect from next month. Paul Zalai the Director and our industry representative for the Freight and Trade Alliance has been featured in this mornings Financial Times, as we anticipate this will have significant impacts nationwide.

As most of our clients are aware this, this adds to further issues the industry has faced in the past few months and with Christmas planning in full flight we anticipate this will have a disastrous impact on all supply chains. Whilst the details are limited at this moment in time and the impact to all specific terminals/vessels/deliveries is unknown, we all understand the broader implications this protected industrial action will have across the entire country.

I have attached to this email several articles and industry notices for you to provide to your teams, as well as your own customers.

Our Operations Team will be in touch with all our customers relating to specific impacts on each shipment when required.

If you have any questions, please don’t hesitate to reach out to any member of the team.

Best regards,

Best regards,

NEOLINK Marketing Team

Blatantly aggressive strike action – FTA – 27.9.21

Port strikes threaten to cripple Christmas – FT – 27.8.21

NEOLINK Announcement – Super Typhoon hits Shanghai – 14.9.21

Tuesday 14th of September 2021

Dear Valued Clients,

As some of you may be aware currently a super typhoon has been impacting the Zhejiang region in China the past 48 hours.

See news articles below:

Since the beginning of the week port operations, warehouses, container yards and flights have all been impacted across Shanghai, as well as Ningbo.

Flights and Vessels that were due in at the beginning of the week have been cancelled/delayed, which we believe will have an estimated 1-week delay on all shipments from the region.

This adds further problems to already existing issues incurred to the region in the past month since the Ningbo Port closure in the middle of August.

We anticipate this will further delay schedules not just from the region, but also the major Guangzhou ports due to vessels not being able to berth.

NEOLINK will be working with our customers in the coming days to understand the impact on all of our customers shipments.

If you have any questions, please feel free to contact any member of the team.

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Do you import containers? Then you need to read this – New Charges being implemented by Australian Ports – 12.8.21

Thursday 12th of August 2021

Dear Valued Clients,

Some of you may be aware that yesterday evening news broke of a COVID case at Ningbo Port.

As a result of the infection, we have seen the second busiest port in China suspend operations adding further pressure on already further constrained supply chains.

NEOLINK has already been informed by one carrier that shipments arriving into Ningbo via Tianjin this week will be delayed up to 4 weeks now due to the suspension in operations.

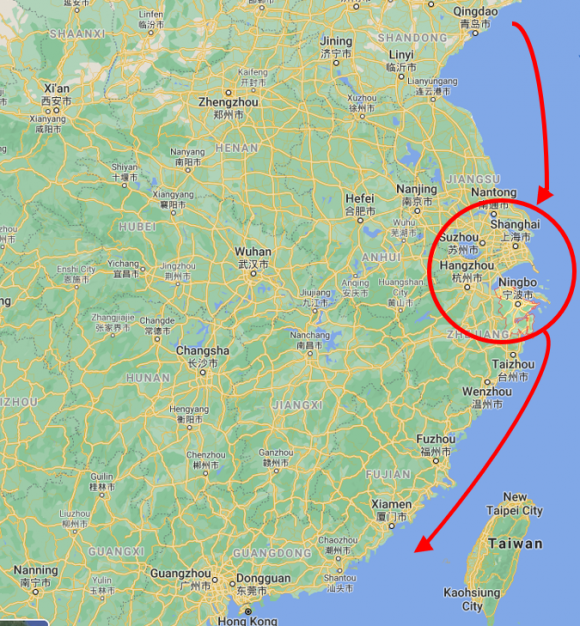

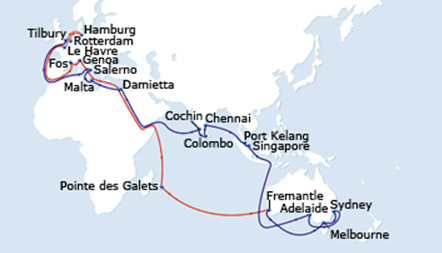

For those who are not aware Ningbo (along with Shanghai) is a strategically important port as it connects the north to the south as vessels then call major ports in Guangzhou before heading southbound to Australia or onto EU/NA:

The impact as such will inevitably have a knock-on effect across all ports and even shipment modes as we start to already field enquiries for Air freights now from the region. All of this comes at a terrible time as factories go into final production schedules before we head into the Black Friday Holidays in November in China and supply chains are planning for end of year holidays across the globe.

We are taking a shipment-by-shipment approach for all of our customers and analysing each set of circumstances to ensure we are providing the best recommendations moving forwards. Switching shipments to other ports and other shipment modes are options but add further costs to already expensive supply chains. However, we anticipate most companies will be making this move as well and as such will have a knock on effect to other ports where there have already been existing delays. Any orders that you currently have in production with your suppliers we now anticipate will have some form of delay, regardless of where you import from China as a result.

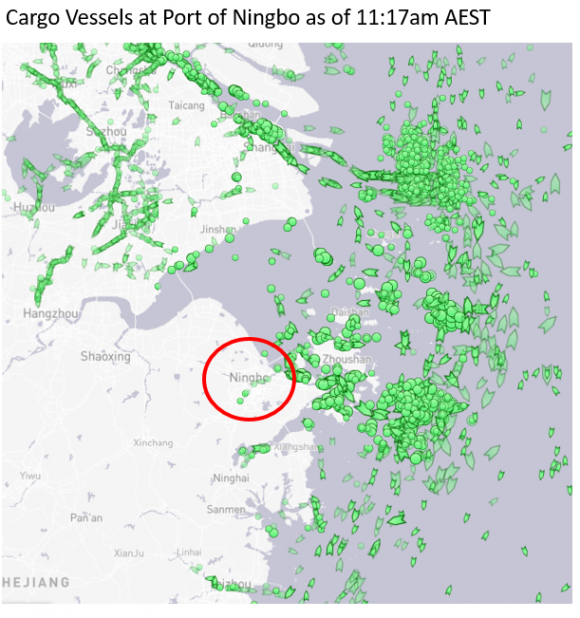

As of yesterday evening their were 68 vessels anchored at Ningbo Zhoushan and Majishan/Shulanghu awaiting entry into the port – please see below:

We will be proactively reaching out to all of our customers that have orders in our system that may be impacted in the area, however the knock-on effect will also inevitably impact all importers buying from China in the coming weeks.

If there are any outstand PO’s you have placed with your factories that are not in our system, please ensure you get them over to us ASAP so we can start planning ahead of time and try to best manage your shipments.

If you have any questions, please don’t hesitate to reach out to any member of the NEOLINK Team.

Sources:

Cheers,

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Do you import containers? Then you need to read this – New Charges being implemented by Australian Ports – 9.8.21

Monday 9th of August 2021

Dear Valued Clients,

Patricks Terminals announced last week that its new container weighing solution Pondus will be live at its Melbourne Terminal Operations from 4th of October 2021 and will be launching in Brisbane from 4th of January 2021.

See Patricks notice attached and details below:

“Pondus is an innovative weighing solution that helps drive safety across the container handling sector. Mis-declared containers create potential safety risks throughout the supply chain from transport companies to terminal operators and shipping lines. This new weighing solution, Pondus, helps identify mis-declared weights by statistically sampling containers for weighing and then automatically notifying customers of weight discrepancies allowing parties to better meet their Chain of Responsibility obligations. Any mis-declared container found outside of the 1-tonne tolerance will be charged a weight amendment fee of $230.00 AUD + GST. If containers are accurately declared, then this fee does not apply.”

The important thing to note with this announcement is that the Weight amendment fee does not just apply to heavy containers but ALL CONTAINERS, regardless of the actual weight. If the weight is 1 tonne different on the container, then this fee will be applicable and payable on COD terms with the terminals in order for us to collect the container from the wharf.

NEOLINK’s Recommended Next Steps

We will work with all of you to ensure this is effectively communicated across all of your respective trade lanes and suppliers, but please understand that suppliers are ultimately the ones responsible for accurate weights being provided.

If you or your suppliers have any questions at all please don’t hesitate to reach out to any member of the NEOLINK Team.

Best regards,

NEOLINK Marketing Team

Patricks Melbourne Terminal – Pondus Weighing Amendment Fee – From October 2021

NEOLINK H1 2021 REVIEW – How did we get here and where to now for Australia’s Global Supply Chains?

Thursday 14th of July 2021

INTRODUCTION

Since the beginning of 2020; Global and Local Supply Chains have been on the COVID 19 rollercoaster – shipping and consumption dropping 13% one minute and in double digit growth the next, in an industry where typically 2% to 3% shifts annually on any data point are the norm.

Whether it is ocean freight rates, local terminal fees, consumer demand, factory production, sailing schedule reliance, empty yard fees, warehousing costs – fundamentally all these areas have experienced >10% shifts in the past 12 months and have driven changes in landed unit costs, pricing, profit margins and will inevitably lead to inflation, which Australian consumers will feel in the coming months/years ahead if they haven’t felt it already.

In this H1 Review we have attempted to synthesize all of the information and data available to provide a clear view in order to help our customers communicate the impact COVID has had on global supply chains with your customers and what this means for all industries moving forwards for the rest of 2021 and beyond.

COVID IMPACT ON CONSUMER DEMAND & INDUSTRY

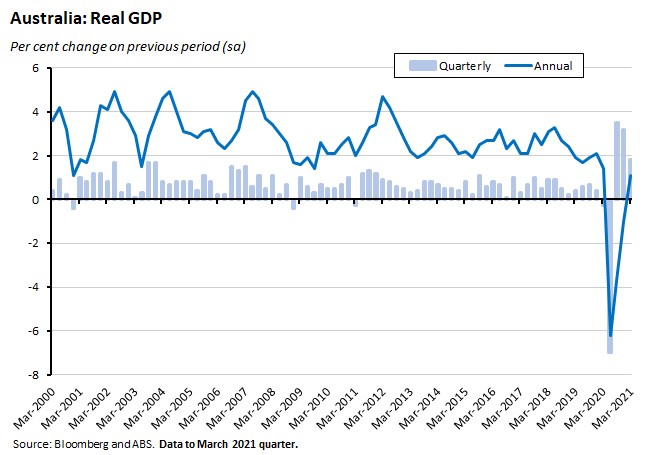

Household consumption is typically one of those very boring data points that largely never changes QTR to QTR, Month to Month and Year to Year here in Australia, as well as other developed western economies. Anything close to a 2% real GDP change was a walk on the wild side, and even the Global Financial Crisis saw a very minimal drop in Quarterly GDP here in Australia and should give context to the impact of COVID 19.

Please see below the -8% drop in GDP in the first QTR of 2020 followed by the biggest GDP QTR’s in the past 20 years:

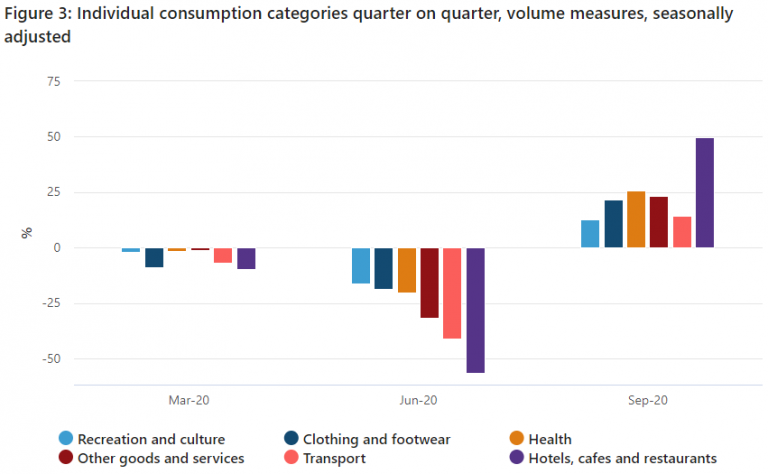

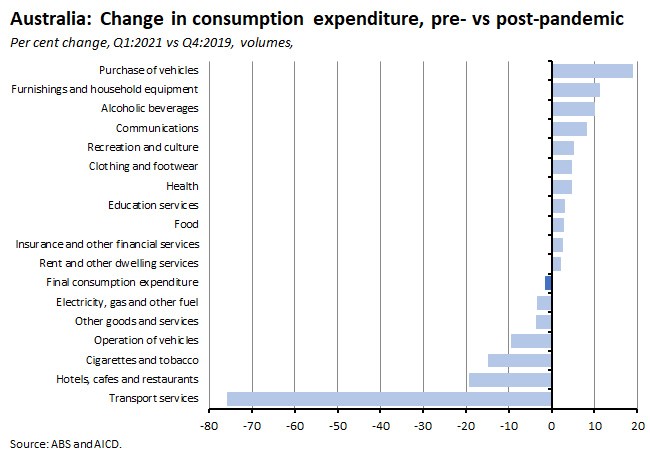

The above/below charts talks to the anecdotal feedback/conversations we have all been having with family, friends, customers, and suppliers since the beginning of the pandemic. Either business is booming or your local café that you get your morning coffee from is no longer in business with Hotels, Cafes and restaurants experiencing the biggest roller coaster of all in the past year.

One minute they are in lockdown with a -50% drop in consumption only propped up by online orders/Deliveroo takeaways and then to be reopened experiencing the biggest growth the industry has had in a QTR for the past 30 years – only to now be locked down again in NSW. See below:

Source: Australian Bureau of Statistics

The significant shifts in consumption are the core reason and driver behind why global supply chains have been so significantly impacted by COVID. The World Shipping Council just this week was quoted stating that the Asian exports to the US has grown by 34% and is the highest quarterly gain since records began (i), as a result this increase/shifts in demand on importers/exporters has created “The Perfect Storm” in the global freight market.

In addition to the above since the beginning of the year we have had to contend with two once in a lifetime scenarios with the Suez Canal Blockage and The Port of Yantian Closure. The Suez Canal Blockage in the early hours of March 23rd of this year effectively put a halt for six days to one of the busiest trade routes in the world – with costed to the global economy an estimated $6.7M USD per minute (xii) and lost shipping capacity of 20 to 30% over a period of multiple weeks following the delay. Delays on vessel schedules around the world were impacted and freight prices across the board jumped 278% in March as a result of the blockage according to the FBX.

The month-long closure at one of the busiest ports in the world (The Port of Yantian) due to a COVID outbreak at the end of May was another once in a lifetime event in the shipping industry. NEOLINK were the first Australian Freight Forwarder to break the news on the 26th of May (xiii), due to an unfortunate client shipment that was impacted with its delivery being blocked at the entry of one of the ports terminals. The Yantian impact had a catastrophic impact on rates to Australia – across ports in China the average 40ft container rate to Australia was around the $3,600 USD mark in May and latest rates in July for the second half of the month is showing rates ranging from $6,400 USD up to $7,000 USD per 40ft.

GLOBAL FREIGHT RATE CHANGES & IMPACT ON SUPPLY CHAINS

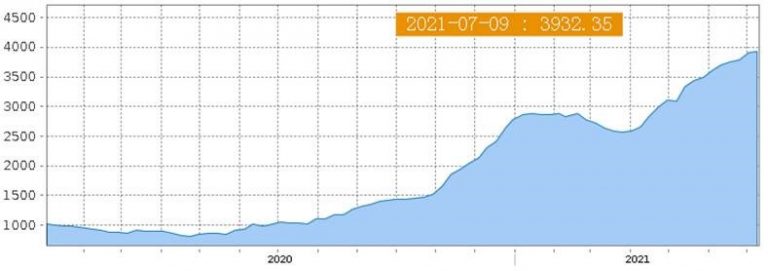

As per the above, Consumer Demand has significantly outstripped the industry’s ability to meet the supply side of the equation even before the Suez Canal and Yantian Port issues this year – shipping lines don’t have enough services or vessels, terminals are not adequately equipped, and container imbalances have resulted in the highest ocean freight rates on record:

FBX Global Freight Rate Index – July 2019 to July 2021 – Per FEU USD

Shanghai Container Freight Rate Index – 2020 to July 2021 – Per TEU USD

The shipping lines have been the focus of the frustration from the rest of the industry as their profits exceed record levels and calls have been made to regulate prices, with Joe Biden expected to sign an executive order in the coming days to put pressure on these carriers . One of the biggest challenges has been that the industry slumped from 2018 to 2020 prior to the pandemic, which resulted in Maersk (worlds #1 shipping line) as well as the other major shipping lines cutting back on Capital Expenditure to an all-time record low. This ultimately resulted in fewer vessels being ordered or going into production as well as fewer new containers being ordered (iii) adding issues to the supply side of the equation prior to 2020.

LANDSIDE OPERATIONS

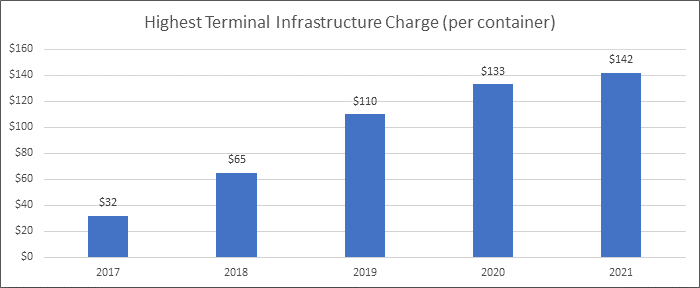

In addition to the shipping lines, landside operations at the major port terminals here in Australia and globally have been significantly impacted with the increase in volume (vi), as well as Scott Morrison famously last year threatening to call in the military on perfectly timed union strikes within the terminals in the height of the pandemic (v). In recent months we can confirm that the MUA has signed new agreements with Hutchinsons and DP World, but are still going through discussions with finalizing an agreement with Patricks. These agreements take average annual salaries at the ports to $170,000 AUD per annum (viii), approx. 283% more than the average Australian income according to the latest data from the Australian Taxation Office (ix).

All of the Australian Port terminal operators (Hutchinsons, DP World, Patricks and VICT) have used the above in recent years to implement new charges called Terminal access fees or Terminal Infrastructure surcharges that have increased from a nominal $30 per container to close to $150 per container this year. This is an additional charge already on top of VBS Fees, port terminal charges and other ocean freight charges, which get ultimately get passed onto importers:

Source xi: Terminal Infrastructure Charges, excludes VBS, Empty Dehire and Local port Charges

Key Areas of Focus and Recommendations Moving Forwards

A consistent theme in all our updates is ensuring we plan as early as possible (especially with Christmas around the corner) and ensuring our customers POs are in our order management system. Please ensure that every time you raise a PO with an overseas supplier we are in CC and engaging our origin offices to start pre booking/communicating with the carriers as well as suppliers. Whilst this does not guarantee a delay won’t occur or a port shutting down operations, it is significantly better than trying to book the week of the cargo being ready. Please plan as early as possible for Christmas.

We have committed that we will not consolidate shipments for commercial benefit in NEOLINK’s interest ahead of our customers, since we have implemented a lot of our workflow automation and Artificial Intelligence capabilities our Customer Operations team are spending more time on the booking part of the supply chain process for all customers individually.

One additional data field we do get from some customers on their purchase orders are RIS dates, which can significantly impact our recommendations and what services we book on. If we know an order is of higher priority this may even result in us recommending an entirely different transport mode altogether i.e., Air Freight if Sea Freight is just not feasible.

Prior to making a booking, NEOLINK and our origin offices are working with the shipping lines to do our best to understand any market forces that can result in booking delays. This is by no means full proof, but we are in control of everything prior to the container being loaded and at the wharf waiting for loading. Once it is on the vessel, we are largely at the mercy of the shipping lines and terminals, which we know are behind schedule and experiencing delays, but try to manoeuvre bookings where we can to reduce the incidence of these events occurring.

NEOLINK for a number of our customers are holding stock in 3PL facilities and are actively encouraging customers to invest/hold more stock to ensure customer deliveries are met where feasible. This is obviously impossible for orders that are either “Made to Order”, “Time specific” or “Just in time” supply chains, but on these customers, we will always ensure we are planning as early as possible.

NEOLINK are working with our customers as best as we can to provide forecasts on costings and rate increases as they come. Ocean Freight rates typically move every fortnight, and we are trying to pre-empt or communicate those increases as soon as possible once released. We have and will also continue to provide USD accounts to customers that want to pay us in USD to mitigate foreign exchange risk – if you don’t have a USD account and would like to be set up, please contact your NEOLINK Customer Ops Coordinator.

On average NEOLINK’s data from over 150 customers & 300+ suppliers is showing an average delay on original Ex-Factory dates of 14 days from the time a PO is placed – so please allow for these delays in addition to any shipping time we provide you. Our team work extremely hard with all our customers to ensure we pre plan and get cargo to Australia as quick as possible, but there are several market forces that are outside of our teams’ control, so please allow for these delays and do not commit to any urgent project without speaking to your NEOLINK Customer Operations contact first.

Sources:

The NEOLINK Team are here to help and assist you during an unprecedented time in modern history as we navigate a market we have never seen before. As such our business has maintained our commitment to continue our overinvestment in technology, automation and artificial intelligence applications to make our team as efficient as possible and enable them to spend more time finding ways to make your supply chain as efficient as possible in return.

If you or any member of your staff have any questions, please don’t hesitate to reach out to any member of the NEOLINK Team.

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Yantian Port Halts Entry for Export Containers Due to COVID Outbreak – 26.5.21

Dear Valued Clients,

At the end of last week there were rumours circulating in China of a Coronavirus outbreak on a vessel at the port of Yantian and potentially causing disruptions at one of the terminals at the port.

Last night AU time we were notified by our China office that an outbreak as spread across parts of the Port and as such the local Port Authorities decided to block the entry of all export containers yesterday afternoon. Inevitably this is going to cause massive space and equipment challenges not just for the port of Yantian but also for Shekou Port as inevitably shippers try to pivot and rebook/redirect cargo to other ports. We also anticipate this will also now start to put more of an upward pressure on already forecasted increases to shipping rates, not just for Sea Freight but also for Air freight as supply chains try to move goods urgently that cannot afford to be caught in the congestion over the coming days.

NEOLINK will be reaching out to customers that have orders where production is being finalised in the coming week to plan ahead as best as we can. If you do have orders in production with your suppliers that our team are not aware of, please let us know ASAP so we can try to come up with alternatives and pivot to avoid the congestion where we can.

Our strong recommendation for any critical orders that were planned for sea freight in the south of china in the next two weeks is to start looking at air freight options given the below.

See articles below:

Please see photos below provided by our office of the road congestion getting into the port:

Our team are monitoring the situation closely and we hope that this disruption can be resolved in the coming days to avoid further delays than it has already caused.

If you have any questions, please don’t hesitate to reach out to your NEOLINK key contact or our senior management.

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Australian Trusted Trader Program – 21.5.21

Friday 21st of May 2021

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Suez Canal Blocked – Delays on EU to AU Shipping – 25.3.21

Thursday 25th of March 2021

Dear Valued Clients,

I am sure that most of you are aware that overnight the Suez Canal has been blocked by an Evergreen vessel that ran aground.

https://www.abc.net.au/news/2021-03-25/suez-canal-remains-blocked-by-enormous-cargo-ship/13273336

The Suez Canal is used by 95% of the shipping lines that move goods to and from Europe to Asia/Australasia:

Approximately 50 to 60 vessels per day travel through the canal and in the past 24 hours we have seen close to 100 vessels waiting at both ends of the canal due to the blockage.

Maritime engineers and experts have been called in to try to resolve the issue, but as it stands this will cause significantly delays to what is already a very challenging shipping market.

We expect shipping lines to potentially re divert ships/cargo now departing Europe via Cape Agulhas (southernmost point of Africa) to avoid the congestion, but this will add a further week to transit times.

At this stage; NEOLINK Account Managers are working closely with all the shipping lines to identify specifically which vessels are caught up in the blockage so we can start to notify customers.

We will proactively be in touch but if you do have any concerns and want to discuss the situation further, please don’t hesitate to contact any member of the team.

Best regards,

NEOLINK Marketing Team

NEOLINK Announcement – Hamburg Sud First Shipping Line to Remove Congestion Surcharge – 5.3.21

Friday 5th of March 2021

Dear Valued Clients,

We wanted to provide you with some positive news we received from Hamburg Sud late yesterday afternoon.

Hamburg Sud have announced that the situation in port botany despite some delays/challenges is improving with their vessel schedules expected to stabilise from mid March. As such they have announced they will be withdrawing the Sydney Congestion Charge, applicable to cargo loaded or received on vessels with a departure date from the 15th of March from its origin port.

This is a big move from Hamburg Sud and will most certainly put pressure on the other shipping lines to follow suit. After being informed about the Hamburg Sud news we received a phone call from senior management at Maersk yesterday evening who also advised us that they expect to also make an announcement of the removal of their Port congestion charge as well within the next 24 hours.

NEOLINK’s policy with the Port Congestion Surcharge (PCS) has to been to pass this purely on at cost and only pass this on when charged. For all of our customers that have been issued with rate cards for the first half of March or have been quoted on upcoming shipments, please note that this is announcement is only for one shipping line at the stage and only applicable from Cargo departing in the 2nd half of this month.

We hope that all of the shipping lines will follow suit quickly, but please note we cannot and will not limit our bookings just to Hamburg Sud in the short term due to a risk of vessels now being overbooked. Your Account Manager and Customer Operations Team will work closely with you on your own individual orders to keep you updated on the options we have to avoid the PCS where we can, but ultimately that is going to be down to the other lines following suit.

If you have any questions at all on the attached, please feel free to contact your Account Manager.

Best regards,

NEOLINK Marketing Team