NEOLINK Global Freight Update and Impact on Australian Supply Chains – 6.7.20

Monday 6th of July 2020

Dear Valued Clients,

As we continue to navigate these challenging times, we appreciate your support and understanding as we work together to manage your supply chains in the most effective way we can.

In this update I will go into some detail about the state of the global freight market, impact on local supply chains and more importantly what we can do to reduce risk to help deliver in full on time for all our customers.

If you are not able to read the detail I have provided a Summary of Key Points below:

Please ensure your NEOLINK Customer Operations Coordinator is kept in the loop on all PO’s that are raised with your suppliers. The earlier we are made aware we can provide our Purchase Order Management service to you all at no cost and this enables us to plan ahead with all carriers as early as possible. In some instances of port congestion we are working closely with our origin agent offices to analyse any shipping lines that may be over booked and ones that have space to provide you with real time updates and mitigate the risk of containers rolling at origin.

In addition to the above summary I have also provided more detail below across four of the major areas we are discussing with our clients at this point in time:

1.Global Ocean Freight Market and Southbound Services

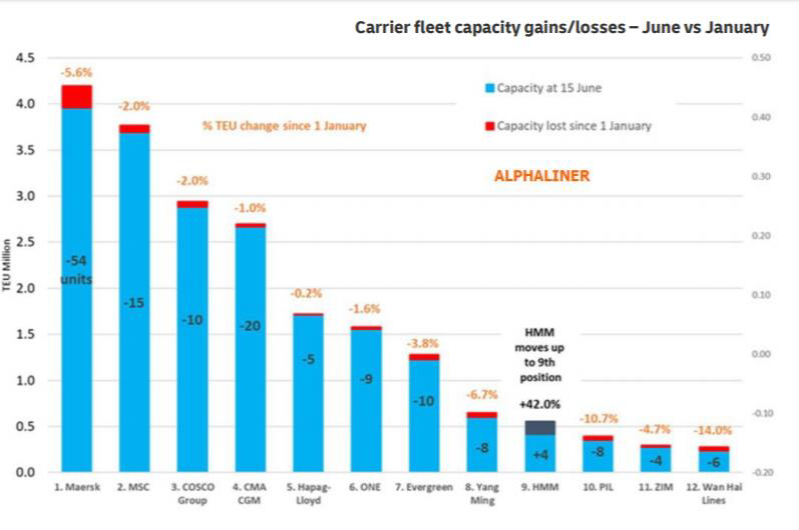

All except one of the major 12 shipping lines have reduced capacity by approx. 5% since the start of 2020 equating to 13.5 million fewer TEU’s being shipped (source: FBX Container Index). This contraction of supply has in the same time period seen an unexpected increase in demand from Australian importers, as our country effectively managed the COVID 19 outbreak relative to most countries.

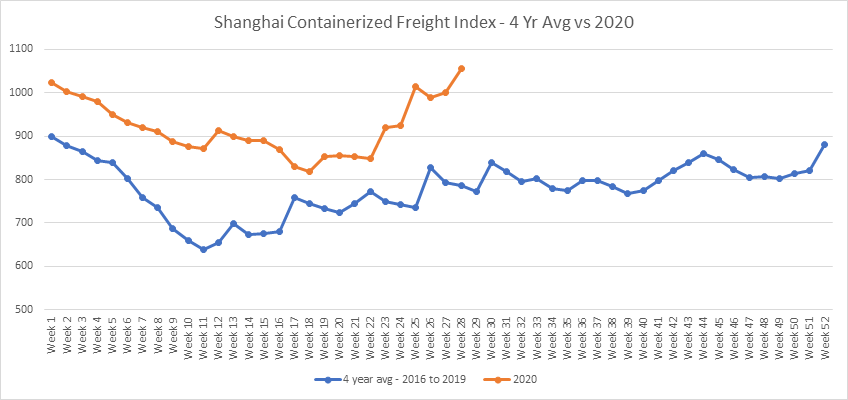

In the past four to six weeks we have also seen the Shanghai Containerized Freight Index and FBX Container Indexes increase by approx. 20 to 30% on average in comparison to prior years (see below). NEOLINK are constantly reviewing the market with our origin partners to ensure we get the best rates possible in market.

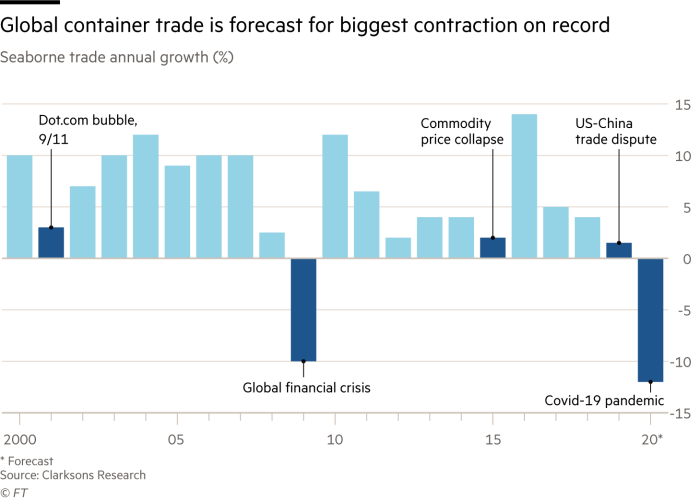

The main driver in the contraction of services put on by the shipping lines has been the overall drop in global trade, despite the growing and increasing demand from Australia. Importers have to contend with the unfortunate reality that global shipping lines seeing a significant drop in profitability in H1 of this year and may be slow to pass on rate reductions as they put on the additional services over “peak season”, due to other markets not performing as strongly.

The space issues incurring particularly at major tranship ports such as Hong Kong, Klang and Singapore are resulting in massive back logs as we head into July. After having conversations with PIL’s General Manager last week, they have over 4 weeks of back log alone in Port Klang, considerably impacting their southbound freight. Cheap shipping rates from tranship through these ports are attracting a significant number of bookings but with that is a high increase of those bookings being rolled or delayed.

One way we are mitigating this risk is by working with our origin partners to check on a daily basis which shipping lines are overbooked or have space relative to the rate and working with our customers on reducing the incidence or containers being rolled before they happen. This may result in rebooking with another line at a higher rate, but avoids delays where we can avoid them.

2.Shipping Line Contracts and Space Guarantees

Shipping Line contracts that are fixed with space guarantees are now starting to introduce new GRI and LSS Surcharges that are variable. Some of our biggest clients that have in excess of 1,000 containers per annum that had fixed rates are seeing their rates come in above market at a premium to hold the space and essentially no one is exempt from avoiding these costs. The shipping lines here locally do not have a lot of appetite at the moment for NAC (named account contracts) and are avoiding them where possible as origin offices are essentially doing what they want and delay bookings regardless of the importer.

Our recommendation as always with our clients is to play the variable freight market and allow us to closely monitor the market with our origin partners. Our Origin offices are always in close contact with your suppliers and working closely with them to forward plan as effectively as possible. If something is extremely urgent or you need a 100% guarantee, some lines will guarantee space at a premium of $200 to $300 USD per TEU if you need that security.

3.Australian Ports Infrastructure Costs and Sydney M8/M5 Toll Increases from 5th of July

In addition to the above Global Freight Market challenges, Australian Ports are implementing a “growth strategy” a term dubbed by Roger Fletcher from the Freight Trade Alliance (FTA) to steadily increase the per container infrastructure fee charges through 2020.

All of the State Governments have been asked by their respective transport ministers over the past 12 months to hold off on fee hikes at the ports and unfortunately has fell on deaf ears not only since COVID, but the past 3 years. DP World alone since the beginning of 2020 increased their port fees by 43% at Port Botany and further increases are expected to continue over the coming months. The Freight and Trade Alliance (FTA) are lobbying on behalf of all importers and Freight Forwarders to combat these charges, but to date have largely been unsuccessful.

DP Worlds Western Australian General Manager has stated “Our industry is experiencing rising costs in the most dynamic and competitive market conditions in decades. We are tackling this across a range of fronts, including delivery of further efficiency and productivity initiatives, and in recent months a workforce restructure. The continuation of the rebalancing of revenue recovery from waterside to landside is necessary to adequately account for landside costs, and fundamental to a sustainable future in this challenging market”.

As a lot of our NSW customers will be aware the new M8 connection opened last week and has resulted in the NSW Transport Minister imposing new toll increases on passenger, as well as commercial vehicles from the 5th of July.

The toll increase across both the M8 and M5 will effectively make it impossible for any delivery that is outside of Zone 1/2 to now avoid tolls, which we will pass onto our customers at cost. All of these increased costs of doing business are to be expected given the times, but we appreciate and understand the challenges these increases present on the ultimate landed unit cost of your goods.

4.Effectively Managing Supply Chain Risk for a Competitive Benefit

Despite the challenges presented, we believe that this also presents a great opportunity to work proactively with our customers to navigate this new market landscape and help compete. NEOLINK have invested heavily in systems automation & tracking capabilities to ensure our team are freed up to focus less on back of house to working closely with your suppliers, shipping lines and local carriers to ensure you get your goods as quick as possible in the most cost effective way possible.

Over the coming weeks our team will focus on engaging with you on the below:

Over the past QTR we have seen a lot of our customers successfully manage this climate by being agile and working with us proactively on all of their import requirements. We appreciate that these are challenging times, but we believe our core competency of combining great people with industry leading technology is leading to our customers in these times really seeing the services levels we can provide. Our team will continue to help support your businesses over the 2nd half of the year and keep you up to date as quickly as possible with any updates we receive.

Best of luck for the new financial year and the rest of 2020!

NEOLINK Management Team